Sports

Swedish Orphan Biovitrum vs. Astria Therapeutics: Stock Comparison

Investors are evaluating the prospects of two biopharmaceutical companies, Swedish Orphan Biovitrum and Astria Therapeutics, as they seek to determine which stock offers superior potential. This analysis contrasts the two firms based on earnings strength, risk factors, analyst recommendations, dividends, valuation metrics, profitability, and institutional ownership.

Profitability and Valuation Insights

Swedish Orphan Biovitrum has demonstrated stronger financial performance, reporting higher revenue and earnings compared to Astria Therapeutics. Furthermore, Swedish Orphan Biovitrum’s price-to-earnings ratio is lower than that of its competitor, suggesting that it may be a more affordable investment at this time.

In profitability measures, a direct comparison shows that Swedish Orphan Biovitrum leads in key metrics such as net margins, return on equity, and return on assets. These figures indicate a robust financial health that may appeal to investors looking for stability.

Institutional Ownership and Analyst Ratings

The institutional ownership for Astria Therapeutics is notably significant, with 99.0% of its shares held by institutional investors. This strong backing indicates confidence from hedge funds, large money managers, and endowments regarding the company’s potential for long-term growth. In contrast, only 4.5% of Astria’s shares are owned by company insiders.

Analyst sentiment also plays a crucial role in stock evaluation. Astria Therapeutics commands a consensus target price of $24.50, which suggests a potential upside of 96.24% from its current trading levels. Analysts appear to favor Astria Therapeutics over Swedish Orphan Biovitrum, highlighting its attractive growth potential despite the latter’s stronger financial metrics.

Risk profiles between the two companies also differ markedly. Swedish Orphan Biovitrum has a beta of 0.37, indicating its stock price is 63% less volatile than the S&P 500 index. In comparison, Astria Therapeutics features an exceptionally low beta of 0.01, suggesting it is 99% less volatile than the broader market. This distinction may appeal to conservative investors seeking stability during uncertain economic conditions.

Swedish Orphan Biovitrum, incorporated in 1939 and headquartered in Solna, Sweden, focuses on the research, development, manufacturing, and sale of pharmaceuticals across various therapeutic areas. Its product offerings include treatments for haemophilia, immunological conditions, and specialty care. The company maintains strategic partnerships with organizations such as Sanofi and Apellis Pharmaceuticals, enhancing its market reach.

On the other hand, Astria Therapeutics, based in Boston, Massachusetts, specializes in therapeutics for allergic and immunological diseases. The company’s lead product candidate, STAR-0215, is currently in Phase 1b/2 clinical trials for hereditary angioedema. Its strategic focus on niche markets could present unique opportunities for growth as it develops innovative therapies.

Investors are encouraged to weigh these factors carefully as they consider the potential risks and rewards associated with each stock. As both companies navigate the complexities of the biopharmaceutical landscape, their respective trajectories will continue to be shaped by market dynamics, clinical advancements, and investor sentiment.

-

World3 months ago

World3 months agoF-22 Raptor vs. Su-57 Felon: A 2025 Fighter Jet Comparison

-

Science2 months ago

Science2 months agoALMA Discovers Companion Orbiting Giant Star π 1 Gruis

-

Science2 months ago

Science2 months agoUniversity of Hawaiʻi Joins $25.6M AI Project for Disaster Monitoring

-

Science3 months ago

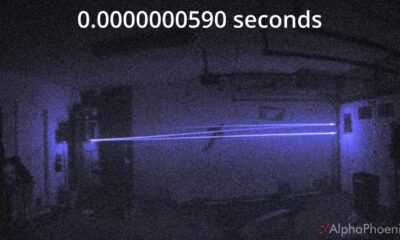

Science3 months agoInnovator Captures Light at 2 Billion Frames Per Second

-

Science3 months ago

Science3 months agoOhio State Study Uncovers Brain Connectivity and Function Links

-

Politics3 months ago

Politics3 months agoHamas Chief Stresses Disarmament Tied to Occupation’s End

-

Entertainment3 months ago

Entertainment3 months agoMegan Thee Stallion Exposes Alleged Online Attack by Bots

-

Science3 months ago

Science3 months agoResearchers Challenge 200-Year-Old Physics Principle with Atomic Engines

-

Entertainment3 months ago

Entertainment3 months agoPaloma Elsesser Shines at LA Event with Iconic Slicked-Back Bun

-

World3 months ago

World3 months agoFDA Unveils Plan to Cut Drug Prices and Boost Biosimilars

-

Business3 months ago

Business3 months agoMotley Fool Wealth Management Reduces Medtronic Holdings by 14.7%

-

Entertainment3 months ago

Entertainment3 months agoBeloved Artist and Community Leader Gloria Rosencrants Passes Away