Business

California Pension Funds Face Growing Debt and Investment Risks

California’s public pension systems are grappling with increasing debt and investment risks, according to a new report from the Reason Foundation. The findings highlight that both the California Public Employees’ Retirement System (CalPERS) and the California State Teachers’ Retirement System (CalSTRS) are taking on more risk while experiencing disappointing investment returns. This trend has led to substantial unfunded liabilities, posing a significant financial burden on taxpayers.

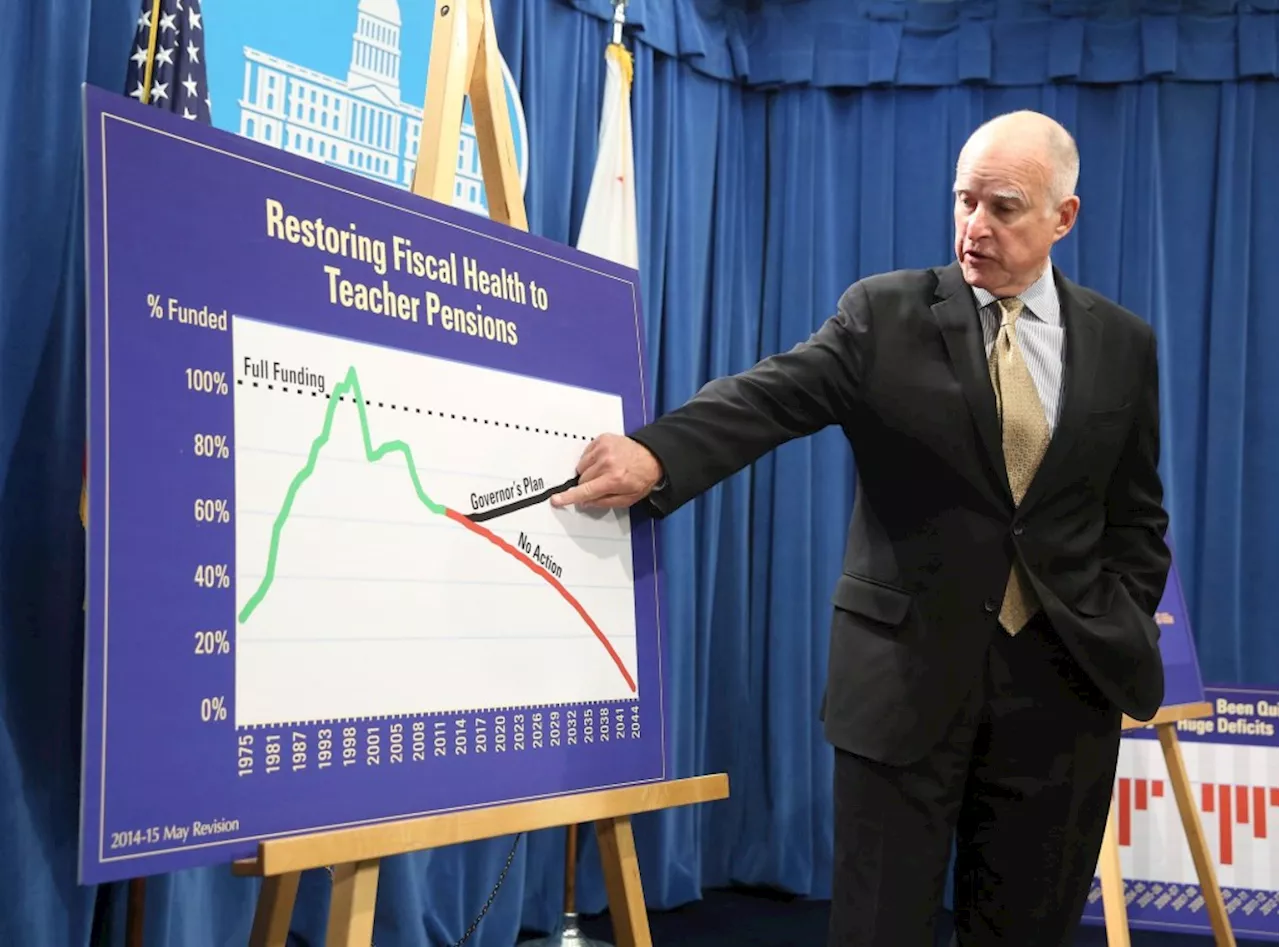

As of now, California’s public pension systems collectively face over $265 billion in unfunded liabilities, the highest in the United States. This translates to more than $6,000 in pension debt for each resident of the state. Specifically, CalPERS is reporting $166 billion in unfunded liabilities, while CalSTRS stands at $39 billion. Given that pension benefits for government employees are constitutionally protected, taxpayers are ultimately responsible for covering this debt.

In response to these financial challenges, pension systems are pursuing various investment strategies to meet their obligations. Many are shifting from traditional investments, such as stocks and bonds, towards higher-risk alternatives like real estate, hedge funds, private equity, and commodities. This strategic pivot raises concerns about the potential for significant losses, which taxpayers would bear in the event of underperformance.

The report indicates that in 2001, only 11% of California’s pension assets were allocated to alternative investments. By 2024, this figure had surged to 37%, ranking California 18th nationally in this regard. Notably, CalPERS has more than doubled its investment in private equity over the last four years, with plans to increase its allocation to 40% of its portfolio.

Despite these efforts, California’s pension systems have not kept pace with returns from their peers. Over the past 20 years, CalPERS and CalSTRS reported average returns of 6.8% and 7.6%, respectively, significantly trailing the S&P 500’s average return of 10.4%. Even with the adoption of higher-risk strategies, California’s pension funds ranked 36th out of 50 states in average investment returns over the last five years, achieving only 7.51%.

The increasing reliance on alternative investments introduces a level of complexity and risk that may not benefit retirees or taxpayers. Many of these investments come with high fees, primarily benefiting fund managers, while their opaque accounting practices can obscure true performance. Underestimating the risks associated with these strategies could exacerbate the financial strain on state and local budgets.

As pension debt continues to rise, the pressure mounts for California’s pension funds to seek higher returns. The consequences of failing to deliver on these returns could result in more funding being diverted from essential services such as infrastructure, education, and public safety to cover pension funding gaps.

In summary, while it is critical for CalPERS, CalSTRS, and other public pension systems to achieve robust investment returns, it is equally important to conduct thorough assessments of downside risks. The current trajectory raises questions about the sustainability of these strategies and the ultimate impact on taxpayers and public employees alike.

-

Science1 month ago

Science1 month agoOhio State Study Uncovers Brain Connectivity and Function Links

-

Politics1 month ago

Politics1 month agoHamas Chief Stresses Disarmament Tied to Occupation’s End

-

Entertainment1 month ago

Entertainment1 month agoMegan Thee Stallion Exposes Alleged Online Attack by Bots

-

Science4 weeks ago

Science4 weeks agoUniversity of Hawaiʻi Joins $25.6M AI Project for Disaster Monitoring

-

Science2 months ago

Science2 months agoResearchers Challenge 200-Year-Old Physics Principle with Atomic Engines

-

Entertainment1 month ago

Entertainment1 month agoPaloma Elsesser Shines at LA Event with Iconic Slicked-Back Bun

-

World1 month ago

World1 month agoFDA Unveils Plan to Cut Drug Prices and Boost Biosimilars

-

Top Stories1 month ago

Top Stories1 month agoFederal Agents Detain Driver in Addison; Protests Erupt Immediately

-

Business1 month ago

Business1 month agoMotley Fool Wealth Management Reduces Medtronic Holdings by 14.7%

-

Entertainment1 month ago

Entertainment1 month agoBeloved Artist and Community Leader Gloria Rosencrants Passes Away

-

Science2 weeks ago

Science2 weeks agoALMA Discovers Companion Orbiting Giant Star π 1 Gruis

-

Politics2 months ago

Politics2 months agoNHP Foundation Secures Land for 158 Affordable Apartments in Denver