Business

Investors Surge Into Bank of America Call Options Amid Insider Trades

A notable surge in options trading for Bank of America Corporation (NYSE:BAC) took place on Wednesday, with investors acquiring a substantial 263,416 call options. This figure marks an approximate increase of 74% compared to the average volume of 150,997 call options typically traded. Such activity indicates heightened investor interest in the financial institution, which has seen robust performance recently.

Insider Transactions and Institutional Investments

In related developments, insider James P. Demare completed a significant stock sale, offloading 148,391 shares of Bank of America on August 1, 2023. The shares were sold at an average price of $45.57, resulting in a total transaction value of $6,762,177.87. Following this sale, Demare’s stake in the company decreased by 39.91%, leaving him with 223,407 shares valued at approximately $10,180,656.99. This transaction was disclosed in a filing with the U.S. Securities and Exchange Commission (SEC).

Several institutional investors have also adjusted their positions in Bank of America. For instance, Nova Wealth Management Inc. increased its holdings by 75.2% in the second quarter, now owning 529 shares valued at $25,000. Similarly, Quaker Wealth Management LLC raised its stake by 246.5%, acquiring an additional 880 shares, bringing its total to 523 shares. New positions have also been established, with RMG Wealth Management LLC purchasing shares valued at about $28,000.

Collectively, institutional investors and hedge funds hold approximately 70.71% of Bank of America’s stock, reflecting confidence in the company’s financial outlook.

Bank of America’s Financial Performance

Shares of Bank of America opened at $52.26 on Thursday, showcasing a steady climb in value. The company reported a market capitalization of $387.06 billion, a price-to-earnings (P/E) ratio of 15.28, and a beta of 1.33. Recent performance metrics show a 12-month low of $33.06 and a 12-month high of $52.88.

On October 15, 2023, Bank of America announced its earnings results for the quarter, revealing earnings per share (EPS) of $1.06, surpassing analysts’ consensus estimate of $0.93 by $0.13. The company reported revenue of $28.09 billion, exceeding the expected $27.05 billion, marking a year-over-year revenue increase of 10.8%. Analysts project an EPS of $3.70 for the current fiscal year.

Additionally, on July 23, 2023, the Board of Directors authorized a substantial stock buyback program, allowing for the repurchase of up to $40 billion in shares, which represents approximately 11.1% of the company’s outstanding shares. This move is often viewed as a signal that the board believes the stock is undervalued.

The financial institution also recently enhanced its shareholder returns by declaring a quarterly dividend of $0.28 per share, paid on September 26, 2023. This represents an annualized dividend of $1.12 and a yield of 2.1%, up from the previous dividend of $0.26. The company’s payout ratio stands at 32.75%.

Analysts’ Ratings and Future Outlook

Equity analysts have offered positive assessments of Bank of America’s stock. Truist Financial raised its price target from $51.00 to $56.00 with a “buy” rating. Similarly, UBS Group increased its target price from $55.00 to $57.00, maintaining a “buy” rating. Other firms, including Evercore ISI and TD Cowen, have also boosted their price targets, reflecting a consensus among analysts that Bank of America remains a strong investment opportunity.

Currently, 21 investment analysts have rated Bank of America with a “buy” rating, while five have assigned a “hold” rating, resulting in an average rating of “Moderate Buy” and a consensus target price of $54.64.

As Bank of America continues to navigate a challenging financial landscape, these developments and investor actions suggest a growing confidence among market participants regarding the company’s future performance and strategic direction.

-

Science1 month ago

Science1 month agoOhio State Study Uncovers Brain Connectivity and Function Links

-

Politics1 month ago

Politics1 month agoHamas Chief Stresses Disarmament Tied to Occupation’s End

-

Science1 month ago

Science1 month agoUniversity of Hawaiʻi Joins $25.6M AI Project for Disaster Monitoring

-

Entertainment1 month ago

Entertainment1 month agoMegan Thee Stallion Exposes Alleged Online Attack by Bots

-

Science4 weeks ago

Science4 weeks agoALMA Discovers Companion Orbiting Giant Star π 1 Gruis

-

Science2 months ago

Science2 months agoResearchers Challenge 200-Year-Old Physics Principle with Atomic Engines

-

Entertainment1 month ago

Entertainment1 month agoPaloma Elsesser Shines at LA Event with Iconic Slicked-Back Bun

-

World1 month ago

World1 month agoFDA Unveils Plan to Cut Drug Prices and Boost Biosimilars

-

Business1 month ago

Business1 month agoMotley Fool Wealth Management Reduces Medtronic Holdings by 14.7%

-

Top Stories1 month ago

Top Stories1 month agoFederal Agents Detain Driver in Addison; Protests Erupt Immediately

-

Entertainment1 month ago

Entertainment1 month agoBeloved Artist and Community Leader Gloria Rosencrants Passes Away

-

Science2 months ago

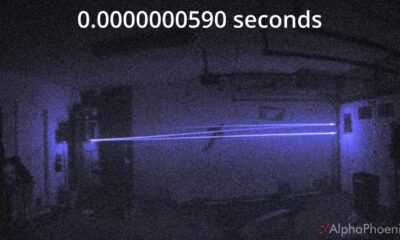

Science2 months agoInnovator Captures Light at 2 Billion Frames Per Second