Health

Alaska Small Businesses Brace for Insurance Premium Surge

Health care costs are poised to dramatically increase for many Alaskans, particularly small business owners, as enhanced subsidies under the Affordable Care Act are set to expire on December 31, 2025. Without the extension of these subsidies, premium rates could surge for thousands, with some individuals facing costs three times higher than current rates.

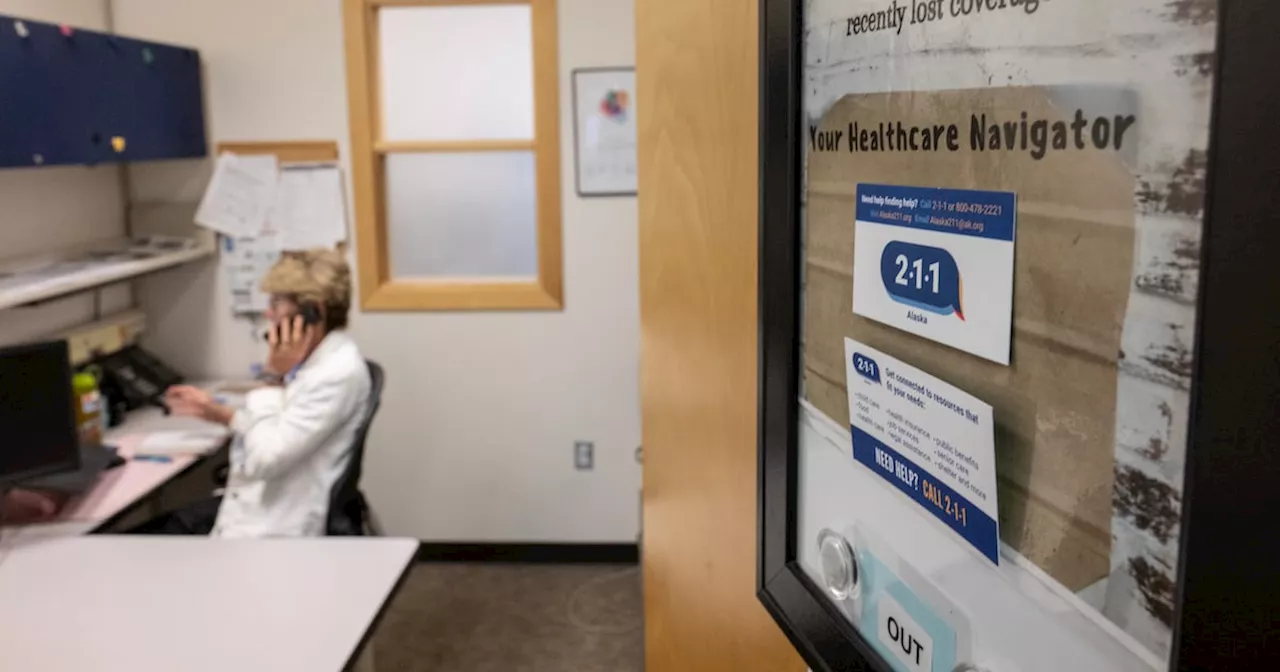

According to Kelly Fehrman, a health care navigator with United Way, many Alaskans who rely on the Affordable Care Act marketplace will be significantly impacted. As she assists clients in navigating their insurance options, the looming expiration of enhanced premium tax credits raises urgent concerns for small business owners.

Brie Loidolt, who operates a bookkeeping business in Anchorage, anticipates that her insurance premiums will rise by approximately $500 monthly, totaling an additional $6,000 annually. Currently, she pays around $1,347 per month. “Who can afford to live when 30% of everything you bring in just pays for insurance and deductible?” Loidolt expressed, highlighting the financial strain small businesses face.

The implications of these rising costs extend beyond individual health care needs. Small business owners fear that the loss of subsidies could cripple their operations. Loidolt is contemplating the possibility of closing her business and laying off employees, a move she describes as “heartbreaking.” She emphasizes, “We’re part of the solution, and this is going to make us part of the problem.”

The political landscape surrounding this issue is equally fraught. The recent conclusion of a lengthy government shutdown did not yield a resolution regarding the extension of the health care subsidies, which were first enacted in 2022. Alaska’s U.S. Senator Lisa Murkowski has expressed her support for a short-term extension of the tax credits to mitigate the impending price increases. Similarly, Senator Dan Sullivan has voiced his backing for the subsidies. However, Representative Nick Begich has not publicly supported their extension.

Small business owner Mark Robokoff, who runs a pet supply shop in Anchorage, is preparing for a staggering rise in his insurance premium, projected to increase from $924 to $2,886 monthly. “This will pull the rug out from under me,” Robokoff stated, stressing that he has always aimed to contribute positively to the community by creating jobs and fostering new businesses.

The potential elimination of tax credits will affect enrollees based on various factors, including income, age, and family size. Those nearing retirement age with incomes at 401% of the poverty line or higher are expected to experience the steepest increases. Of the approximately 25,000 Alaskans enrolled in Affordable Care Act plans, many are small business owners whose contributions to the state’s economy are now at risk.

For many, the fear of rising costs has led to drastic re-evaluations of their business operations. Robokoff noted that he will have to reassess every aspect of his store, from pricing to employee wages. “It’s an entirely new calculus,” he said, reflecting the uncertainty that many small business owners are experiencing.

Concerns about affordability are echoed by Nan Schleusner, a human resources consultant in Anchorage. She and her husband have relied on Affordable Care Act insurance since the enhanced tax credits became available. However, now facing annual premiums of $37,000 and a deductible of $15,000, she is considering alternative employment options to secure health coverage. “I’ve been doing this for 15 years, and I feel called to do it,” Schleusner remarked, expressing her desire to maintain her consulting business.

The urgency for congressional action is palpable, as Alaskans are already making decisions about their health insurance for 2026. As Mark Robokoff put it, “I feel absolutely abandoned,” emphasizing the need for advocacy from local representatives. With the deadline approaching, small business owners are left hoping for a timely intervention that could alleviate what they describe as a “punishing” situation.

In light of these developments, the future of small businesses in Alaska hangs in the balance, dependent on the decisions made by Congress in the coming weeks. Small business owners remain on high alert, awaiting clarity on their health insurance options as the expiration date for subsidies looms.

-

Science3 weeks ago

Science3 weeks agoOhio State Study Uncovers Brain Connectivity and Function Links

-

Politics3 weeks ago

Politics3 weeks agoHamas Chief Stresses Disarmament Tied to Occupation’s End

-

Entertainment3 weeks ago

Entertainment3 weeks agoMegan Thee Stallion Exposes Alleged Online Attack by Bots

-

Science1 month ago

Science1 month agoResearchers Challenge 200-Year-Old Physics Principle with Atomic Engines

-

World3 weeks ago

World3 weeks agoFDA Unveils Plan to Cut Drug Prices and Boost Biosimilars

-

Entertainment3 weeks ago

Entertainment3 weeks agoPaloma Elsesser Shines at LA Event with Iconic Slicked-Back Bun

-

Top Stories3 weeks ago

Top Stories3 weeks agoFederal Agents Detain Driver in Addison; Protests Erupt Immediately

-

Business3 weeks ago

Business3 weeks agoMotley Fool Wealth Management Reduces Medtronic Holdings by 14.7%

-

Entertainment3 weeks ago

Entertainment3 weeks agoBeloved Artist and Community Leader Gloria Rosencrants Passes Away

-

Business3 weeks ago

Business3 weeks agoHome Depot Slashes Prices on Halloween Favorites Up to 75%

-

Politics1 month ago

Politics1 month agoNHP Foundation Secures Land for 158 Affordable Apartments in Denver

-

Top Stories3 weeks ago

Top Stories3 weeks agoOrioles Hire Craig Albernaz as New Manager Amid Rebuild