Science

Market Conditions Echo Past Boom, Raising Investor Concerns

Market conditions in 2023 are drawing comparisons to the last significant boom that peaked nearly four years ago. Current indicators include soaring public tech valuations, robust startup investments, and emerging signs of potential instability in new offerings. These similarities prompt scrutiny from investors and analysts alike, who recall the patterns that preceded the downturn.

Soaring Public Tech Valuations

Both the market peak in late 2021 and today’s environment feature remarkable highs for tech stocks. In November 2021, the Nasdaq Composite index reached its all-time record, surpassing 16,000 points, primarily driven by escalating tech share prices. Currently, the index is approaching a new peak of over 23,000. The five largest technology firms now boast a combined market capitalization exceeding $16 trillion. Companies such as AMD, Palantir Technologies, and Broadcom have also achieved significant gains this year. While private startups do not experience daily valuation shifts like their public counterparts, investor sentiment in the public markets heavily influences private funding dynamics.

Venture Investment Remains Robust

The venture capital landscape mirrors the enthusiasm of late 2021, when global startup funding reached a record-breaking total of more than $640 billion. This figure was nearly double the previous year’s investment level. In 2023, global startup funding has totaled approximately $303 billion in the first three quarters, indicating a strong investment climate, albeit not approaching the peak levels of 2021. The surge in investor interest is particularly evident in the artificial intelligence sector, highlighted by OpenAI‘s landmark financing of $40 billion in March. The pace of unicorn creation also appears to be accelerating, suggesting continued investor enthusiasm.

The competition among investors for promising startups has led to a notable rise in follow-on funding rounds at elevated valuations. According to data from Crunchbase, numerous companies have successfully transitioned from Series A to Series C funding in less than a year, signifying a rapid escalation in perceived value among investors.

Despite these positive trends, some caution is warranted.

Emerging Cracks in the Investment Landscape

During the previous market peak, certain red flags began to emerge, signaling potential instability despite an otherwise vibrant investment environment. Notably, companies that went public through Special Purpose Acquisition Companies (SPACs) exhibited concerning performance. Well-known entities like WeWork and Buzzfeed became examples of significant underperformance within that cohort.

Currently, the market for new public offerings has shown mixed results. For instance, shares of Figma, one of the more highly anticipated IPOs in recent months, have declined over 60% from their peak. Similar downward trends have been observed with online banking provider Chime and stablecoin platform Circle. While these companies maintain relatively high valuations by various metrics, the downward trajectory in share prices raises concerns among investors.

As investors assess current market conditions, they will be looking for further signs of instability. Questions regarding the sustainability of financing for high-profile AI companies and the sluggishness of the IPO pipeline are likely to dominate discussions in the coming months. The emergence of cracks in the investment landscape can signal whether the market is nearing another peak or if it has already passed that threshold.

Investors and analysts alike are advised to remain vigilant as the market continues to evolve. Understanding these dynamics could prove crucial in navigating the current landscape, especially as history suggests that fluctuations are inevitable.

-

Science2 months ago

Science2 months agoOhio State Study Uncovers Brain Connectivity and Function Links

-

Politics2 months ago

Politics2 months agoHamas Chief Stresses Disarmament Tied to Occupation’s End

-

Science1 month ago

Science1 month agoUniversity of Hawaiʻi Joins $25.6M AI Project for Disaster Monitoring

-

Science4 weeks ago

Science4 weeks agoALMA Discovers Companion Orbiting Giant Star π 1 Gruis

-

Entertainment2 months ago

Entertainment2 months agoMegan Thee Stallion Exposes Alleged Online Attack by Bots

-

Science2 months ago

Science2 months agoResearchers Challenge 200-Year-Old Physics Principle with Atomic Engines

-

Entertainment2 months ago

Entertainment2 months agoPaloma Elsesser Shines at LA Event with Iconic Slicked-Back Bun

-

World1 month ago

World1 month agoFDA Unveils Plan to Cut Drug Prices and Boost Biosimilars

-

Business2 months ago

Business2 months agoMotley Fool Wealth Management Reduces Medtronic Holdings by 14.7%

-

Science2 months ago

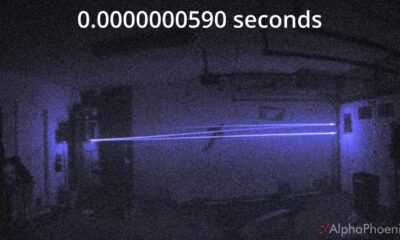

Science2 months agoInnovator Captures Light at 2 Billion Frames Per Second

-

Top Stories2 months ago

Top Stories2 months agoFederal Agents Detain Driver in Addison; Protests Erupt Immediately

-

Entertainment1 month ago

Entertainment1 month agoBeloved Artist and Community Leader Gloria Rosencrants Passes Away