Politics

TriSalus Life Sciences Sees Price Target Increase to $12.00

TriSalus Life Sciences (NASDAQ: TLSI) received a significant boost to its stock price target, with Canaccord Genuity Group raising it from $11.00 to $12.00 in a research note published on November 29, 2023. This adjustment reflects a positive outlook, as Canaccord maintains a buy rating on the stock.

Analysts have shown varied sentiments regarding TriSalus Life Sciences, with Wall Street Zen upgrading the stock from a “sell” to a “hold” status on November 28, 2023. Conversely, Weiss Ratings reaffirmed a “sell (D-)” rating earlier this week. Currently, three investment analysts have given the company a buy rating, while one has issued a hold and another a sell rating. According to MarketBeat, the consensus rating for TriSalus Life Sciences stands at “hold,” with a price target of $11.00.

Recent Financial Performance

TriSalus Life Sciences recently announced its quarterly earnings on November 13, 2023, reporting an earnings per share (EPS) of ($0.96). This figure fell short of the consensus estimate of ($0.17) by ($0.79). The company generated revenue of $11.57 million for the quarter, slightly below the predicted $11.76 million. Analysts anticipate that TriSalus will post an EPS of ($1.55) for the current fiscal year.

Institutional Investment Trends

Institutional investors have recently adjusted their stakes in TriSalus Life Sciences. Nantahala Capital Management LLC increased its holdings by 2.0% in the third quarter, now owning 2,040,245 shares valued at approximately $9.49 million. Similarly, Millennium Management LLC raised its stake by 17.7%, acquiring an additional 5,359 shares in the last quarter, bringing its total to 35,612 shares worth $166,000.

Squarepoint Ops LLC and White Pine Capital LLC also entered new positions in TriSalus, valued at approximately $343,000 and $278,000, respectively. Notably, Vanguard Group Inc. significantly expanded its holdings by 42.4%, acquiring an additional 345,186 shares and bringing its total to 1,159,575 shares, worth approximately $5.39 million. In total, institutional investors currently own about 2.58% of the company’s stock.

TriSalus Life Sciences operates as a clinical-stage biotechnology company, focusing on non-invasive drug–device combination therapies for oncology. Utilizing advanced electroporation and ultrasound technologies, the firm aims to enhance the localized delivery and effectiveness of chemotherapeutic agents while minimizing systemic toxicity. Its lead programs target challenging head and neck cancers, addressing significant needs for improved tumor control and patient tolerability.

As the company continues to navigate its clinical trials and market strategies, the recent adjustments in analyst ratings and institutional investments may play a crucial role in shaping its future trajectory. Interested parties can stay updated on TriSalus Life Sciences by subscribing to daily news summaries from MarketBeat.

-

Science2 months ago

Science2 months agoOhio State Study Uncovers Brain Connectivity and Function Links

-

Science2 months ago

Science2 months agoUniversity of Hawaiʻi Joins $25.6M AI Project for Disaster Monitoring

-

Science1 month ago

Science1 month agoALMA Discovers Companion Orbiting Giant Star π 1 Gruis

-

Politics2 months ago

Politics2 months agoHamas Chief Stresses Disarmament Tied to Occupation’s End

-

World2 months ago

World2 months agoF-22 Raptor vs. Su-57 Felon: A 2025 Fighter Jet Comparison

-

Science2 months ago

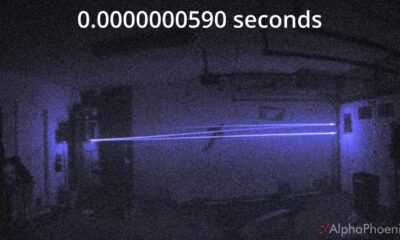

Science2 months agoInnovator Captures Light at 2 Billion Frames Per Second

-

Entertainment2 months ago

Entertainment2 months agoMegan Thee Stallion Exposes Alleged Online Attack by Bots

-

Science2 months ago

Science2 months agoResearchers Challenge 200-Year-Old Physics Principle with Atomic Engines

-

Entertainment2 months ago

Entertainment2 months agoPaloma Elsesser Shines at LA Event with Iconic Slicked-Back Bun

-

World2 months ago

World2 months agoFDA Unveils Plan to Cut Drug Prices and Boost Biosimilars

-

Business2 months ago

Business2 months agoMotley Fool Wealth Management Reduces Medtronic Holdings by 14.7%

-

Top Stories2 months ago

Top Stories2 months agoFederal Agents Detain Driver in Addison; Protests Erupt Immediately