Business

SEC Eases Crypto Enforcement Under Trump’s Second Term

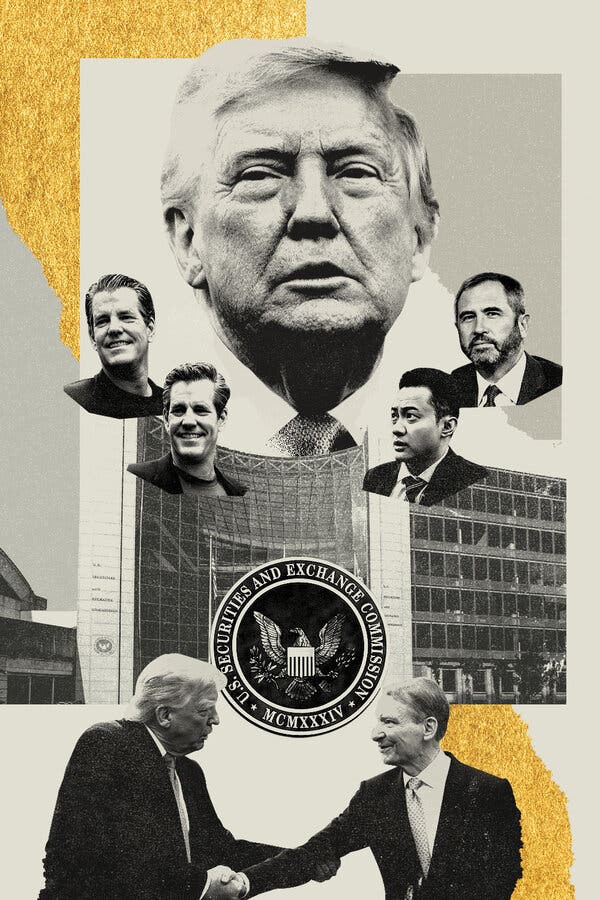

The Securities and Exchange Commission (SEC) has taken a markedly different approach to cryptocurrency enforcement following the return of Donald J. Trump to the White House. Notably, the agency has paused or dismissed several cases against major cryptocurrency firms, including a lawsuit against a company led by the billionaire Winklevoss twins. This shift reflects a broader transformation in how the federal government interacts with the crypto industry during Trump’s second term.

In a striking analysis by the New York Times, it was revealed that the SEC has reduced its aggressive stance against the cryptocurrency sector, easing up on more than 60 percent of the ongoing cases since Trump resumed office. The SEC’s actions included the decision to freeze the lawsuit against the Winklevoss-operated firm, as well as a notable withdrawal of a case against Binance, the largest cryptocurrency exchange globally.

Transformation of SEC’s Approach

The SEC’s retreat from these cases is unprecedented. Historically, the agency has maintained a stringent enforcement policy against potential violations within the cryptocurrency market. However, under Trump’s administration, the SEC has shifted its focus, moving to pause litigation, reduce penalties, or dismiss lawsuits entirely. This pattern is particularly evident in the case of Ripple Labs, where the SEC sought to lessen a court-ordered penalty against the company.

The implications of this shift are significant. The SEC’s dismissals of cases related to crypto firms have occurred at a much higher rate compared to other sectors. During Trump’s first term, the SEC filed 50 cases against cryptocurrency entities, but under the Biden administration, that number surged to 105 cases. In contrast, Trump’s second term has seen no new cases filed against crypto firms.

Political Connections and Impacts

The connection between the Trump administration and key players in the cryptocurrency space raises further questions about the motivations behind this regulatory shift. The Winklevoss twins, for instance, have ties to Trump through their investments and donations, including a notable contribution of $2 million to a pro-Trump fundraising committee. Such connections have led to speculation about the influence of political relationships on regulatory actions.

As the landscape of cryptocurrency regulation continues to evolve, the SEC’s current stance may set a precedent for future enforcement actions. The impact of these changes on the broader market remains to be seen, but the current administration’s leniency could embolden cryptocurrency firms navigating an already complex regulatory environment.

The SEC’s pivot illustrates the dynamic intersection of politics and business, where regulatory frameworks can shift dramatically based on leadership and administrative priorities. As the crypto industry continues to grow, stakeholders will be watching closely to see how these developments unfold in the coming months.

-

Science2 months ago

Science2 months agoOhio State Study Uncovers Brain Connectivity and Function Links

-

Politics2 months ago

Politics2 months agoHamas Chief Stresses Disarmament Tied to Occupation’s End

-

Science1 month ago

Science1 month agoUniversity of Hawaiʻi Joins $25.6M AI Project for Disaster Monitoring

-

Science1 month ago

Science1 month agoALMA Discovers Companion Orbiting Giant Star π 1 Gruis

-

Entertainment2 months ago

Entertainment2 months agoMegan Thee Stallion Exposes Alleged Online Attack by Bots

-

Science2 months ago

Science2 months agoResearchers Challenge 200-Year-Old Physics Principle with Atomic Engines

-

Entertainment2 months ago

Entertainment2 months agoPaloma Elsesser Shines at LA Event with Iconic Slicked-Back Bun

-

World2 months ago

World2 months agoFDA Unveils Plan to Cut Drug Prices and Boost Biosimilars

-

Science2 months ago

Science2 months agoInnovator Captures Light at 2 Billion Frames Per Second

-

Top Stories2 months ago

Top Stories2 months agoFederal Agents Detain Driver in Addison; Protests Erupt Immediately

-

Business2 months ago

Business2 months agoMotley Fool Wealth Management Reduces Medtronic Holdings by 14.7%

-

Entertainment2 months ago

Entertainment2 months agoBeloved Artist and Community Leader Gloria Rosencrants Passes Away