Top Stories

Nvidia’s Blockbuster Earnings Propel Tech Stocks, AI Confidence Soars

UPDATE: Nvidia’s Q3 earnings have ignited a surge in tech stocks as confidence in the AI trade rebounds. The chipmaker reported a staggering $57 billion in revenue, a 62% increase year-over-year, reigniting investor enthusiasm just hours ago.

The tech sector experienced a dramatic turnaround on Thursday, October 12, 2023, as Nvidia’s impressive results sparked a rally across the market. Shares of Nvidia skyrocketed 5%, boosting the entire tech and AI sector. Notable gains included Super Micro Computer at +6.4%, Advanced Micro Devices at +4.6%, and Broadcom at +3.3%.

Major U.S. indexes reflected this momentum, with the Nasdaq leading the charge, surging more than 2%. Here’s how the indexes stood at the 9:30 a.m. opening bell:

– S&P 500: 6,742.50, up 1.5%

– Dow Jones Industrial Average: 46,637.69, up 1.13% (+521 points)

– Nasdaq composite: 23,037.78, up 2%

Investor confidence had been wavering recently due to concerns over high valuations and rising capital expenditures in AI. However, Nvidia’s performance has reassured many that the demand for AI chips remains robust. The company anticipates revenue of $65 billion for the current quarter, surpassing analysts’ expectations of $61 billion.

“It has been many decades since one stock could move the market like Nvidia,” said David Rosenberg, a prominent economist and president of Rosenberg Research. He noted that Nvidia’s results have alleviated the malaise gripping growth stocks in recent weeks.

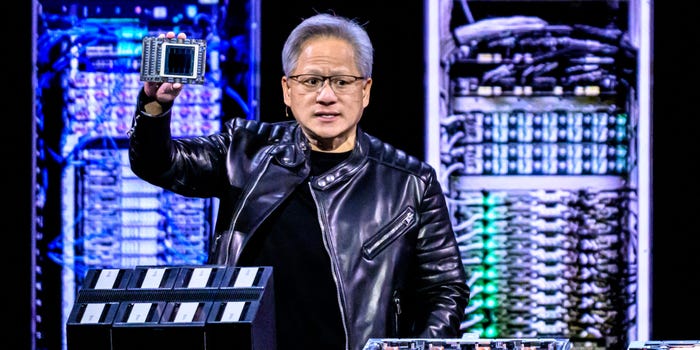

Jensen Huang, Nvidia’s CEO, provided critical insights during the conference call that analysts deemed essential. According to Dan Ives from Wedbush Securities, Huang’s remarks were what tech bulls “NEEDED to hear.” Ives emphasized that Nvidia is the foundation for the AI Revolution, with Huang positioned uniquely to discuss enterprise AI demand.

Despite this surge of optimism, skepticism persists regarding the sustainability of this growth. Rosenberg cautioned,

“This remains a bubble of epic proportions, keep that in mind.”

He expressed doubts about the AI market expanding eightfold in the next five years, a figure currently being priced into stocks.

As investors digest these developments, all eyes are on Nvidia and its potential to sustain this momentum in the coming months. What happens next could define the future of tech investments and the AI sector as a whole.

Stay tuned for more updates as this story develops.

-

Science1 month ago

Science1 month agoOhio State Study Uncovers Brain Connectivity and Function Links

-

Politics1 month ago

Politics1 month agoHamas Chief Stresses Disarmament Tied to Occupation’s End

-

Entertainment1 month ago

Entertainment1 month agoMegan Thee Stallion Exposes Alleged Online Attack by Bots

-

Science4 weeks ago

Science4 weeks agoUniversity of Hawaiʻi Joins $25.6M AI Project for Disaster Monitoring

-

Science2 months ago

Science2 months agoResearchers Challenge 200-Year-Old Physics Principle with Atomic Engines

-

Entertainment1 month ago

Entertainment1 month agoPaloma Elsesser Shines at LA Event with Iconic Slicked-Back Bun

-

World1 month ago

World1 month agoFDA Unveils Plan to Cut Drug Prices and Boost Biosimilars

-

Top Stories1 month ago

Top Stories1 month agoFederal Agents Detain Driver in Addison; Protests Erupt Immediately

-

Business1 month ago

Business1 month agoMotley Fool Wealth Management Reduces Medtronic Holdings by 14.7%

-

Entertainment1 month ago

Entertainment1 month agoBeloved Artist and Community Leader Gloria Rosencrants Passes Away

-

Politics1 month ago

Politics1 month agoNHP Foundation Secures Land for 158 Affordable Apartments in Denver

-

Science2 weeks ago

Science2 weeks agoALMA Discovers Companion Orbiting Giant Star π 1 Gruis