Top Stories

Bank of England Maintains 4% Rate, Cuts £70 Billion in Bonds

UPDATE: The Bank of England has just announced a critical decision to maintain its Bank Rate at 4% during the September 2025 Monetary Policy Committee (MPC) meeting. This decision, confirmed at 0935 GMT (0535 US Eastern Time), comes alongside a significant £70 billion reduction in the stock of government bonds held for monetary policy purposes over the next year.

Authorities report that the MPC voted 7-2 in favor of this decision, indicating a cautious approach as markets anticipate future rate adjustments. While further rate cuts are possible, their timing will hinge on evolving inflation trends and any signs of sustained weakening in the labor market.

The implications of this announcement are immediate and far-reaching. With inflation remaining a pressing concern, the Bank’s decision to maintain the rate reflects a careful balancing act between curbing inflation and supporting economic growth. Analysts emphasize that the Bank’s cautious stance may influence consumer confidence and spending in the coming months.

Huw Pill, the Bank of England’s Chief Economist, highlighted the need for vigilance in the face of economic uncertainties. In a statement, Pill remarked,

“We must carefully monitor inflation and labor market conditions to guide our next steps.”

As the financial markets react to this news, investors are closely watching for any shifts in economic indicators that could prompt a change in policy. The decision to cut government bond holdings by £70 billion signals the Bank’s commitment to navigating a complex economic landscape.

What happens next is crucial. Analysts predict that the Bank will need to react swiftly to any new data on inflation and employment. The next MPC meeting will be a key date for stakeholders eager to understand the trajectory of monetary policy.

This decision underscores the Bank of England’s ongoing efforts to stabilize the economy amid fluctuating market conditions. As the situation develops, stakeholders are advised to stay informed about forthcoming economic reports that could influence future monetary policy.

Stay tuned for further updates as we monitor this evolving story.

-

Science2 months ago

Science2 months agoOhio State Study Uncovers Brain Connectivity and Function Links

-

Science1 month ago

Science1 month agoUniversity of Hawaiʻi Joins $25.6M AI Project for Disaster Monitoring

-

Politics2 months ago

Politics2 months agoHamas Chief Stresses Disarmament Tied to Occupation’s End

-

Science1 month ago

Science1 month agoALMA Discovers Companion Orbiting Giant Star π 1 Gruis

-

Entertainment2 months ago

Entertainment2 months agoMegan Thee Stallion Exposes Alleged Online Attack by Bots

-

Science2 months ago

Science2 months agoResearchers Challenge 200-Year-Old Physics Principle with Atomic Engines

-

Entertainment2 months ago

Entertainment2 months agoPaloma Elsesser Shines at LA Event with Iconic Slicked-Back Bun

-

Science2 months ago

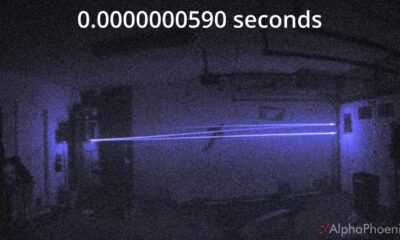

Science2 months agoInnovator Captures Light at 2 Billion Frames Per Second

-

World2 months ago

World2 months agoFDA Unveils Plan to Cut Drug Prices and Boost Biosimilars

-

World2 months ago

World2 months agoF-22 Raptor vs. Su-57 Felon: A 2025 Fighter Jet Comparison

-

Business2 months ago

Business2 months agoMotley Fool Wealth Management Reduces Medtronic Holdings by 14.7%

-

Top Stories2 months ago

Top Stories2 months agoFederal Agents Detain Driver in Addison; Protests Erupt Immediately