Top Stories

Australia Jobs Report Misses Expectations, Markets React Urgently

UPDATE: Australia has reported a shocking employment decline of -21,300 jobs for November, far below the expected +20,000. This unexpected miss is sending ripples through the markets as investors react to the implications for the Australian economy.

The unemployment rate remained stable, but only due to a three-point drop in the participation rate. The AUD fell approximately 20 pips following the announcement, highlighting the immediate fallout from this disappointing jobs data.

Investors are also grappling with a broader risk aversion in the markets, compounded by a significant drop in shares of Oracle, which fell 11% following disappointing earnings. This marks a staggering 50% decline since Oracle’s previous earnings spike, raising concerns about ongoing overspending in AI and its profitability.

In international developments, Mexico has just approved tariffs as high as 50% on imports from China and other Asian countries, potentially reshaping trade dynamics. This move could lead to negotiations with the United States to establish a trade bloc that could replace the influx of low-cost Chinese goods.

In commodity markets, gold has dipped by $15 to $4,212, while silver saw a brief surge to $62.88 before profit-taking led to a reversal. The U.S. 10-year yields also fell by 4 basis points to 4.12%, reflecting investor sentiment amid these developments.

Market analysts suggest the bearish trend in the Australian dollar is likely to persist as investors reassess their positions in light of the soft jobs report and the broader economic landscape. The S&P 500 futures are down 53 points, or 0.8%, reflecting the cautious mood among traders.

As these economic indicators continue to unfold, the focus will remain on the implications for market stability and potential shifts in investment strategy. Analysts urge vigilance as the situation develops throughout the day.

This article has been prepared by Adam Button at investinglive.com, providing real-time insights into rapidly changing market conditions. Stay tuned for further updates as the story develops.

-

Science1 month ago

Science1 month agoOhio State Study Uncovers Brain Connectivity and Function Links

-

Politics2 months ago

Politics2 months agoHamas Chief Stresses Disarmament Tied to Occupation’s End

-

Science1 month ago

Science1 month agoUniversity of Hawaiʻi Joins $25.6M AI Project for Disaster Monitoring

-

Entertainment1 month ago

Entertainment1 month agoMegan Thee Stallion Exposes Alleged Online Attack by Bots

-

Science4 weeks ago

Science4 weeks agoALMA Discovers Companion Orbiting Giant Star π 1 Gruis

-

Science2 months ago

Science2 months agoResearchers Challenge 200-Year-Old Physics Principle with Atomic Engines

-

Entertainment1 month ago

Entertainment1 month agoPaloma Elsesser Shines at LA Event with Iconic Slicked-Back Bun

-

World1 month ago

World1 month agoFDA Unveils Plan to Cut Drug Prices and Boost Biosimilars

-

Top Stories2 months ago

Top Stories2 months agoFederal Agents Detain Driver in Addison; Protests Erupt Immediately

-

Business1 month ago

Business1 month agoMotley Fool Wealth Management Reduces Medtronic Holdings by 14.7%

-

Entertainment1 month ago

Entertainment1 month agoBeloved Artist and Community Leader Gloria Rosencrants Passes Away

-

Science2 months ago

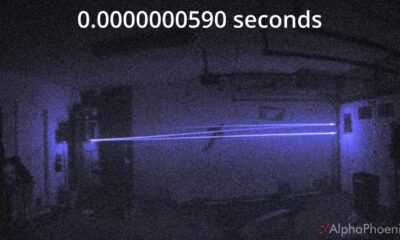

Science2 months agoInnovator Captures Light at 2 Billion Frames Per Second