Health

Anxiety Mounts as ACA Tax Credit Deadlock Approaches Enrollment Deadline

An ongoing deadlock regarding tax credits associated with the Affordable Care Act (ACA) is raising concerns among health care stakeholders as the open enrollment period approaches. With only two weeks remaining until the enrollment begins on October 15, 2023, uncertainty looms over how the federal government shutdown will impact access to affordable health care.

Health Care Stakeholders Express Concerns

As the federal government remains in shutdown, the implications for the ACA tax credits have become increasingly critical. These tax credits are essential for many individuals and families seeking affordable health insurance coverage. Without a resolution, millions of Americans could face higher premiums, potentially undermining the progress made in expanding health care access.

The Coalition to Strengthen America’s Healthcare has voiced strong concerns over the potential fallout from this stalemate. Stakeholders in the health care industry, including insurers and consumer advocates, are urging lawmakers to prioritize a resolution. They emphasize that the lack of timely action could result in significant disruptions at a time when individuals are preparing to enroll in new plans.

Impact of the Federal Shutdown

The ongoing federal shutdown complicates an already tense situation. With healthcare reform and funding in a state of limbo, experts are warning that delays in approving tax credits could lead to confusion for consumers during the critical enrollment period. Many rely on these credits to make necessary health coverage affordable.

According to recent data, approximately 13 million Americans benefited from ACA tax credits in the last enrollment cycle, highlighting the importance of swift governmental action. The current stalemate could see these numbers dwindle if individuals are deterred from enrolling due to uncertainty.

Health care leaders are calling on Congress to break the impasse and ensure that tax credits are renewed without delay. They argue that timely legislative action is essential to prevent a potential public health crisis stemming from lack of coverage.

As the countdown to the enrollment period continues, the pressure mounts for lawmakers to reach a consensus. The consequences of inaction could reverberate throughout the health care system, impacting not only individuals but also the providers and institutions that serve them.

In summary, the deadlock over ACA tax credits poses a significant threat to health care access for millions of Americans. With the deadline for enrollment fast approaching, stakeholders are urging swift action to ensure that individuals can secure the coverage they need without facing financial burdens.

-

Science2 months ago

Science2 months agoOhio State Study Uncovers Brain Connectivity and Function Links

-

Politics2 months ago

Politics2 months agoHamas Chief Stresses Disarmament Tied to Occupation’s End

-

Science1 month ago

Science1 month agoUniversity of Hawaiʻi Joins $25.6M AI Project for Disaster Monitoring

-

Science4 weeks ago

Science4 weeks agoALMA Discovers Companion Orbiting Giant Star π 1 Gruis

-

Entertainment2 months ago

Entertainment2 months agoMegan Thee Stallion Exposes Alleged Online Attack by Bots

-

Science2 months ago

Science2 months agoResearchers Challenge 200-Year-Old Physics Principle with Atomic Engines

-

Entertainment2 months ago

Entertainment2 months agoPaloma Elsesser Shines at LA Event with Iconic Slicked-Back Bun

-

World1 month ago

World1 month agoFDA Unveils Plan to Cut Drug Prices and Boost Biosimilars

-

Business2 months ago

Business2 months agoMotley Fool Wealth Management Reduces Medtronic Holdings by 14.7%

-

Science2 months ago

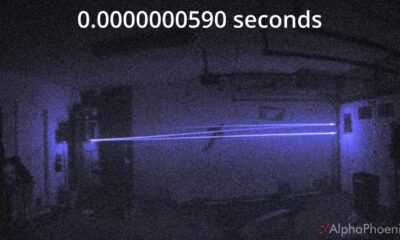

Science2 months agoInnovator Captures Light at 2 Billion Frames Per Second

-

Top Stories2 months ago

Top Stories2 months agoFederal Agents Detain Driver in Addison; Protests Erupt Immediately

-

Entertainment1 month ago

Entertainment1 month agoBeloved Artist and Community Leader Gloria Rosencrants Passes Away