Business

Yolo County Homeowners Face Urgent Property Tax Deadline

Homeowners in Yolo County are reminded that the deadline for the first installment of their 2025-26 property taxes is approaching. The Yolo County Tax Collector’s Office has announced that payments are due starting November 1, 2025. Property owners must ensure that payments are completed by 5:00 p.m. on December 10, 2025, to avoid a hefty 10 percent penalty, as mandated by the California Revenue & Taxation Code.

For those considering their payment options, it is important to act promptly. If mailing a payment, the postmark must be from the U.S. Postal Service and dated no later than December 10. Alternatively, homeowners can make payments through electronic means, either online or via phone. However, it is essential to note that credit and debit card payments incur a 2.34 percent convenience fee, while e-check payments are free of charge. All transactions must be finalized by 11:59 p.m. on December 10, 2025. The Tax Collector’s Office advises that electronic payments may take up to three business days to process, making early action crucial.

A significant reminder from the County is that homeowners cannot claim ignorance if they do not receive their tax bill. The law holds no leniency for those who fail to act, even if their mailbox is empty. Homeowners who have not received their tax bill should contact the Yolo County Tax Collector’s Office at (530) 666-8625 or email [email protected]. Additionally, inquiries and in-person payments can be made at their office located at 625 Court Street, Room 102, Woodland. The office operates Monday through Friday from 8:00 a.m. to 4:00 p.m., with extended hours until 5:00 p.m. on December 10.

Understanding the importance of timely property tax payments goes beyond just avoiding penalties. These taxes play a critical role in funding local services such as schools, community colleges, and fire districts. In fact, rural fire districts rely on property taxes for over 90 percent of their annual funding. Overall, the County collects about 9 percent of total property tax revenue, equating to roughly 9 cents of every tax dollar paid.

By making timely payments, homeowners contribute to essential community services, ensuring the well-being and safety of all residents in Yolo County.

-

Science1 month ago

Science1 month agoOhio State Study Uncovers Brain Connectivity and Function Links

-

Politics2 months ago

Politics2 months agoHamas Chief Stresses Disarmament Tied to Occupation’s End

-

Science1 month ago

Science1 month agoUniversity of Hawaiʻi Joins $25.6M AI Project for Disaster Monitoring

-

Entertainment1 month ago

Entertainment1 month agoMegan Thee Stallion Exposes Alleged Online Attack by Bots

-

Science4 weeks ago

Science4 weeks agoALMA Discovers Companion Orbiting Giant Star π 1 Gruis

-

Science2 months ago

Science2 months agoResearchers Challenge 200-Year-Old Physics Principle with Atomic Engines

-

Entertainment1 month ago

Entertainment1 month agoPaloma Elsesser Shines at LA Event with Iconic Slicked-Back Bun

-

World1 month ago

World1 month agoFDA Unveils Plan to Cut Drug Prices and Boost Biosimilars

-

Business1 month ago

Business1 month agoMotley Fool Wealth Management Reduces Medtronic Holdings by 14.7%

-

Top Stories2 months ago

Top Stories2 months agoFederal Agents Detain Driver in Addison; Protests Erupt Immediately

-

Entertainment1 month ago

Entertainment1 month agoBeloved Artist and Community Leader Gloria Rosencrants Passes Away

-

Science2 months ago

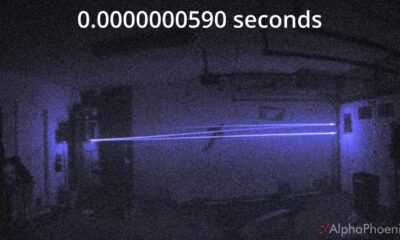

Science2 months agoInnovator Captures Light at 2 Billion Frames Per Second