Business

Vista Finance Expands Investment in Green Brick Partners by 4.1%

Vista Finance LLC has increased its ownership in Green Brick Partners, Inc. (NASDAQ: GRBK) by 4.1% during the second quarter of 2023. According to a filing with the Securities and Exchange Commission (SEC), Vista Finance now holds 5,211 shares of the homebuilding and land development company after acquiring an additional 204 shares during the quarter. As of the latest disclosure, these shares are valued at approximately $328,000.

Several other institutional investors have also adjusted their stakes in Green Brick Partners. Notably, The Manufacturers Life Insurance Company raised its position by 56.7% in the first quarter, now owning 453,977 shares valued at $26.47 million after purchasing an additional 164,273 shares. Granahan Investment Management LLC entered a new position in the same quarter, investing around $6.7 million. Allianz Asset Management GmbH increased its holdings by 171.7% during the second quarter, now owning 131,310 shares valued at $8.26 million. Additionally, Annex Advisory Services LLC raised its stake by 16.3%, bringing its total to 546,427 shares valued at $34.36 million. Hedge funds and institutional investors now collectively own 78.24% of the company’s stock.

Analyst Ratings and Insider Activity

In a separate development, B. Riley initiated coverage on Green Brick Partners on June 30, 2023, assigning a “neutral” rating with a price target of $62.00. Currently, analysts provide a consensus rating of “Hold” for the stock, with an average price target of $66.00.

On August 12, 2023, Chief Operating Officer Jed Dolson sold 20,000 shares of the company’s stock at an average price of $66.76, totaling $1.34 million. Following this transaction, Dolson holds 273,605 shares, valued at approximately $18.27 million, reflecting a decrease of 6.81% in his ownership. This sale has been reported in an SEC filing.

Current Market Performance of Green Brick Partners

As of Friday, Green Brick Partners’ stock opened at $67.24, with a market capitalization of $2.93 billion. The company has a price-to-earnings (P/E) ratio of 8.73 and a beta of 1.96, indicating a higher volatility compared to the market. It maintains a debt-to-equity ratio of 0.20, a quick ratio of 0.63, and a current ratio of 7.57.

The stock has experienced fluctuations, with a fifty-two week low of $50.57 and a high of $84.19. Green Brick Partners last reported its quarterly earnings on July 30, 2023, revealing earnings per share of $1.85, which fell short of analysts’ estimates of $1.94. The company’s return on equity stands at 25.35%, with a net margin of 17.70%. Year-over-year revenue has decreased by 2.1%, compared to $2.32 earnings per share from the same quarter in the previous year. Analysts predict earnings per share of $8.34 for the current fiscal year.

Green Brick Partners, Inc. operates as a diversified homebuilding and land development firm in the United States, structured through three segments: Builder Operations Central, Builder Operations Southeast, and Land Development. Its operations focus primarily on home construction and delivery across various states.

-

Science1 month ago

Science1 month agoOhio State Study Uncovers Brain Connectivity and Function Links

-

Politics2 months ago

Politics2 months agoHamas Chief Stresses Disarmament Tied to Occupation’s End

-

Science1 month ago

Science1 month agoUniversity of Hawaiʻi Joins $25.6M AI Project for Disaster Monitoring

-

Entertainment1 month ago

Entertainment1 month agoMegan Thee Stallion Exposes Alleged Online Attack by Bots

-

Science4 weeks ago

Science4 weeks agoALMA Discovers Companion Orbiting Giant Star π 1 Gruis

-

Science2 months ago

Science2 months agoResearchers Challenge 200-Year-Old Physics Principle with Atomic Engines

-

Entertainment1 month ago

Entertainment1 month agoPaloma Elsesser Shines at LA Event with Iconic Slicked-Back Bun

-

World1 month ago

World1 month agoFDA Unveils Plan to Cut Drug Prices and Boost Biosimilars

-

Business1 month ago

Business1 month agoMotley Fool Wealth Management Reduces Medtronic Holdings by 14.7%

-

Top Stories2 months ago

Top Stories2 months agoFederal Agents Detain Driver in Addison; Protests Erupt Immediately

-

Entertainment1 month ago

Entertainment1 month agoBeloved Artist and Community Leader Gloria Rosencrants Passes Away

-

Science2 months ago

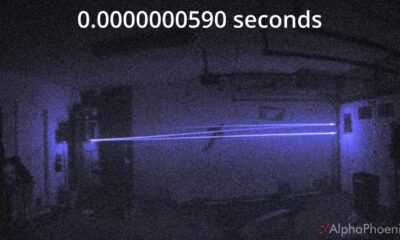

Science2 months agoInnovator Captures Light at 2 Billion Frames Per Second