Business

Treasury Investigates Minnesota’s Somali Community for Fraud

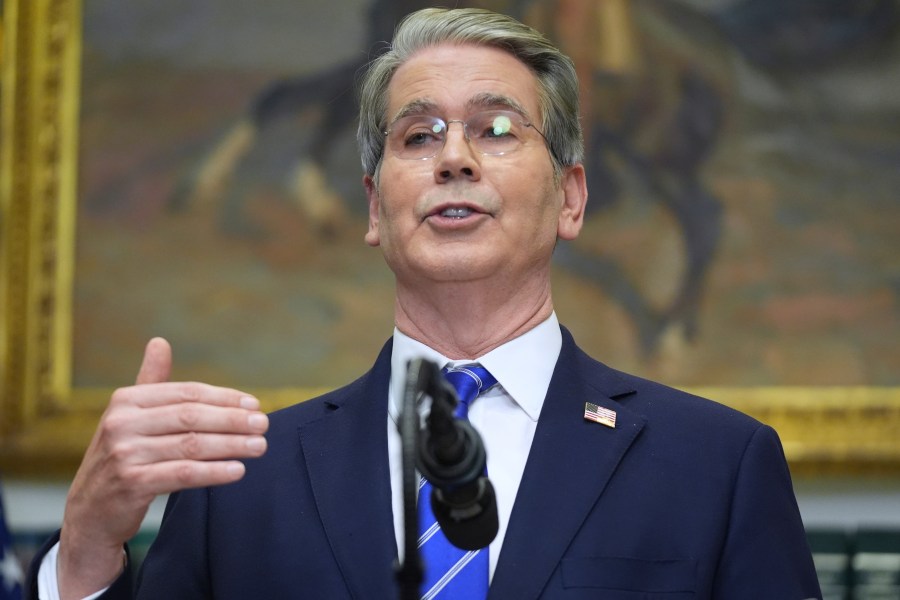

The U.S. Treasury Department has intensified its investigations into businesses that facilitate wire transfers for the Somali community in Minnesota. This announcement was made by Treasury Secretary Scott Bessent on Friday, highlighting a broader crackdown on suspected fraud within this diaspora. The move aligns with the policies of the Trump administration, which has increasingly focused on immigration enforcement against the Somali population in the state.

The investigations are part of a larger initiative to monitor financial transactions that may be linked to illegal activities. Many members of Minnesota’s Somali community rely on these wire transfer businesses to send money to family abroad, particularly to Somalia. The Treasury’s scrutiny raises concerns about the impact on legitimate financial activities, as well as the potential stigma associated with the community.

Secretary Bessent stated that the Treasury is committed to ensuring that financial systems are not exploited for fraudulent activities. “We are taking action to protect the integrity of our financial system,” he emphasized. The investigations aim to identify any irregularities in money transfers that may indicate fraudulent behavior.

In recent years, Minnesota has become home to one of the largest Somali communities in the United States. This demographic shift has brought both cultural diversity and challenges in integration. The heightened scrutiny from federal authorities has put added pressure on community members, who fear that legitimate transactions may be misconstrued as illicit.

The investigations have sparked a conversation about the relationship between the Somali community and federal agencies. Many advocates argue that the targeting of Somali businesses can exacerbate distrust between these communities and law enforcement. They stress the importance of balancing security measures with the need for accessible financial services.

As these investigations unfold, community leaders are calling for transparency and dialogue with the Treasury Department. They argue that clear communication can help alleviate fears and ensure that businesses operate within legal boundaries without being unfairly penalized.

In Minnesota, where the Somali population has established a robust network of support and entrepreneurship, the outcome of these investigations may have significant implications. The focus on wire transfer businesses, crucial for many families supporting relatives overseas, underscores the challenges facing immigrant communities in navigating regulatory environments.

The Treasury Department’s approach reflects a growing trend towards stringent oversight of financial transactions, particularly those involving immigrant populations. As the investigations progress, the balance between combating fraud and fostering community trust will be critical in shaping future policies.

-

Science2 months ago

Science2 months agoOhio State Study Uncovers Brain Connectivity and Function Links

-

Politics2 months ago

Politics2 months agoHamas Chief Stresses Disarmament Tied to Occupation’s End

-

Science1 month ago

Science1 month agoUniversity of Hawaiʻi Joins $25.6M AI Project for Disaster Monitoring

-

Science4 weeks ago

Science4 weeks agoALMA Discovers Companion Orbiting Giant Star π 1 Gruis

-

Entertainment2 months ago

Entertainment2 months agoMegan Thee Stallion Exposes Alleged Online Attack by Bots

-

Science2 months ago

Science2 months agoResearchers Challenge 200-Year-Old Physics Principle with Atomic Engines

-

Entertainment2 months ago

Entertainment2 months agoPaloma Elsesser Shines at LA Event with Iconic Slicked-Back Bun

-

World1 month ago

World1 month agoFDA Unveils Plan to Cut Drug Prices and Boost Biosimilars

-

Science2 months ago

Science2 months agoInnovator Captures Light at 2 Billion Frames Per Second

-

Business2 months ago

Business2 months agoMotley Fool Wealth Management Reduces Medtronic Holdings by 14.7%

-

Top Stories2 months ago

Top Stories2 months agoFederal Agents Detain Driver in Addison; Protests Erupt Immediately

-

Entertainment1 month ago

Entertainment1 month agoBeloved Artist and Community Leader Gloria Rosencrants Passes Away