Business

Jacobsen Capital Management Increases Stake in AbbVie by 11.6%

Jacobsen Capital Management has expanded its investment in AbbVie Inc. (NYSE: ABBV), increasing its holdings by 11.6% during the second quarter of 2023. According to a recent filing with the Securities and Exchange Commission, the institutional investor now owns a total of 3,690 shares after acquiring an additional 385 shares in this period. As of the latest report, Jacobsen’s investment in AbbVie is valued at approximately $685,000.

A number of other institutional investors have also adjusted their stakes in AbbVie. For instance, Schulhoff & Co. Inc. raised its position by 0.5%, resulting in ownership of 27,771 shares valued at $5.15 million, following an acquisition of 130 shares. Meanwhile, Cullen Frost Bankers Inc. increased its holdings by 3.1%, now owning 396,225 shares worth $73.55 million, after purchasing an additional 11,730 shares. St. Johns Investment Management Company LLC and Wallace Advisory Group LLC also made notable increases in their investments, adding 7.8% and 9.9% respectively.

Currently, institutional investors hold 70.23% of AbbVie’s shares, indicating strong support from the financial sector.

Analysts’ Perspectives on AbbVie

AbbVie has been frequently discussed among analysts, with several recent research reports highlighting its potential. Piper Sandler raised its target price for AbbVie from $231.00 to $284.00, maintaining an “overweight” rating. Similarly, Cantor Fitzgerald set a target price of $250.00 with an “overweight” rating, while JPMorgan Chase & Co. increased its price objective from $200.00 to $235.00. Meanwhile, HSBC Global Research downgraded AbbVie from a “strong-buy” to a “hold” rating.

Overall, two analysts have assigned a “Strong Buy” rating, sixteen have rated it as a “Buy,” and nine analysts have given it a “Hold” rating, resulting in a consensus rating of “Moderate Buy” with an average target price of $234.80, according to MarketBeat.com.

Market Performance and Financial Results

On October 10, 2023, AbbVie shares opened at $231.48, experiencing a slight decline of 0.2%. The company has seen a one-year range with a low of $163.81 and a high of $244.81. AbbVie boasts a market capitalization of $408.93 billion, a price-to-earnings ratio of 110.23, a PEG ratio of 1.45, and a beta of 0.51.

In its most recent quarterly earnings report, released on July 31, 2023, AbbVie reported earnings per share (EPS) of $2.97, falling short of analyst expectations of $3.24 by $0.27. The company achieved revenue of $15.42 billion, surpassing expectations of $14.93 billion and representing a 6.6% increase compared to the same period last year.

Analysts predict that AbbVie will report an EPS of $12.31 for the current fiscal year.

Dividend Announcements and Insider Trading

AbbVie recently declared a quarterly dividend of $1.64, scheduled for payment on November 14, 2023. Stockholders of record by October 15, 2023, will receive this dividend, which translates to an annualized payout of $6.56 and a dividend yield of 2.8%. The company’s dividend payout ratio stands at a substantial 312.38%.

In other news, company executives have engaged in significant stock transactions. Executive Vice President Nicholas Donoghoe sold 13,295 shares at an average price of $198.51, totaling approximately $2.64 million. Following this sale, he retains 58,247 shares valued at about $11.56 million. Another executive, Azita Saleki-Gerhardt, sold 42,370 shares at an average price of $198.42, amounting to approximately $8.41 million.

Corporate insiders hold a mere 0.08% of AbbVie’s stock, indicating that the majority of shares are held by institutional investors and the public.

AbbVie Inc. continues to be a significant player in the pharmaceutical industry, providing a range of treatments for various ailments, including autoimmune diseases and cancers. Its ongoing adjustments in market strategies and investments reflect a robust commitment to growth and shareholder value.

-

Science2 months ago

Science2 months agoOhio State Study Uncovers Brain Connectivity and Function Links

-

Politics2 months ago

Politics2 months agoHamas Chief Stresses Disarmament Tied to Occupation’s End

-

Science1 month ago

Science1 month agoUniversity of Hawaiʻi Joins $25.6M AI Project for Disaster Monitoring

-

Entertainment2 months ago

Entertainment2 months agoMegan Thee Stallion Exposes Alleged Online Attack by Bots

-

Science4 weeks ago

Science4 weeks agoALMA Discovers Companion Orbiting Giant Star π 1 Gruis

-

Science2 months ago

Science2 months agoResearchers Challenge 200-Year-Old Physics Principle with Atomic Engines

-

Entertainment1 month ago

Entertainment1 month agoPaloma Elsesser Shines at LA Event with Iconic Slicked-Back Bun

-

World1 month ago

World1 month agoFDA Unveils Plan to Cut Drug Prices and Boost Biosimilars

-

Business1 month ago

Business1 month agoMotley Fool Wealth Management Reduces Medtronic Holdings by 14.7%

-

Top Stories2 months ago

Top Stories2 months agoFederal Agents Detain Driver in Addison; Protests Erupt Immediately

-

Entertainment1 month ago

Entertainment1 month agoBeloved Artist and Community Leader Gloria Rosencrants Passes Away

-

Science2 months ago

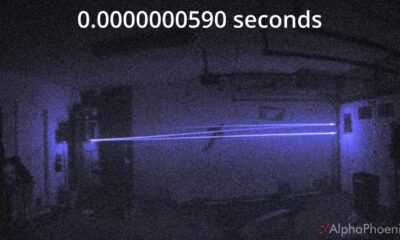

Science2 months agoInnovator Captures Light at 2 Billion Frames Per Second