Business

Ghana to Regulate Cryptocurrency by 2025 Following $3 Billion Trade Surge

Ghana’s central bank is set to introduce a regulatory framework for cryptocurrency by December 2025, following significant trading activity that has reached $3 billion among approximately 3 million users. Governor Johnson Asiama confirmed this development during the International Monetary Fund’s (IMF) fall meetings in Washington, emphasizing the need for formal oversight as the country witnesses a surge in digital asset adoption.

Draft Bill and New Department for Crypto Oversight

The Bank of Ghana (BoG) is actively drafting legislation that will be presented to Parliament before the end of this year. Governor Asiama stated, “That bill is on its way to parliament, hopefully before the end of December, we should be able to regulate cryptocurrencies in Ghana.” This initiative is part of a broader effort to establish a dedicated department tasked with overseeing cryptocurrency transactions and ensuring compliance with regulatory standards.

Ghana’s move aligns with a broader trend in Africa, where several nations are rapidly developing regulatory frameworks for cryptocurrencies. Kenya has recently passed its Virtual Asset Service Providers Bill, while Nigeria and South Africa have implemented their own regulations governing exchanges and taxation related to digital currencies. Until now, Ghana had taken a cautious approach, advising citizens that cryptocurrencies are not recognized as legal tender.

Growing Adoption and Economic Implications

The rapid adoption of cryptocurrencies in Ghana cannot be overlooked. From July 2023 to June 2024, Ghanaians engaged in more than $3 billion in cryptocurrency trades, with nearly 9% of the population utilizing digital assets for various purposes, including payments, savings, and remittances. Governor Asiama acknowledged the urgency of the situation, stating, “We can no longer ignore it, and we’re trying very hard to be able to regulate that.”

The forthcoming bill is expected to provide a legal foundation for licensing cryptocurrency exchanges and monitoring digital asset activities. To further support this initiative, the BoG is piloting a digital sandbox, allowing selected companies to explore cryptocurrency services under regulatory supervision.

Despite the ambitious plans, challenges remain for the Bank of Ghana. The central bank has yet to recruit and train personnel to manage the new regulatory department. Analysts, such as Isaac Simpson from Stanbic Bank Ghana, have cautioned that the nation risks falling behind in the digital economy if progress isn’t made swiftly. Simpson noted that “the digital train has left the station,” urging immediate action from the government.

Ghana’s upcoming cryptocurrency legislation could significantly impact West Africa’s digital economy. As adoption continues to rise, establishing a regulatory framework may provide critical structure, potentially attracting new investment opportunities. With time running out, the effectiveness of Ghana’s strategy remains to be seen.

-

Science2 months ago

Science2 months agoOhio State Study Uncovers Brain Connectivity and Function Links

-

Politics2 months ago

Politics2 months agoHamas Chief Stresses Disarmament Tied to Occupation’s End

-

Science1 month ago

Science1 month agoUniversity of Hawaiʻi Joins $25.6M AI Project for Disaster Monitoring

-

Science4 weeks ago

Science4 weeks agoALMA Discovers Companion Orbiting Giant Star π 1 Gruis

-

Entertainment2 months ago

Entertainment2 months agoMegan Thee Stallion Exposes Alleged Online Attack by Bots

-

Science2 months ago

Science2 months agoResearchers Challenge 200-Year-Old Physics Principle with Atomic Engines

-

Entertainment2 months ago

Entertainment2 months agoPaloma Elsesser Shines at LA Event with Iconic Slicked-Back Bun

-

World1 month ago

World1 month agoFDA Unveils Plan to Cut Drug Prices and Boost Biosimilars

-

Business2 months ago

Business2 months agoMotley Fool Wealth Management Reduces Medtronic Holdings by 14.7%

-

Science2 months ago

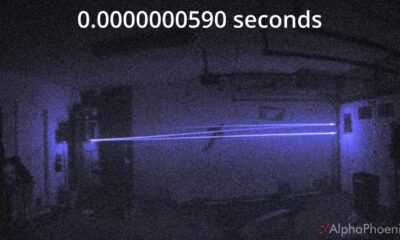

Science2 months agoInnovator Captures Light at 2 Billion Frames Per Second

-

Top Stories2 months ago

Top Stories2 months agoFederal Agents Detain Driver in Addison; Protests Erupt Immediately

-

Entertainment1 month ago

Entertainment1 month agoBeloved Artist and Community Leader Gloria Rosencrants Passes Away