Politics

Connecticut Enacts Strict Earned Wage Access Laws Amid Industry Shift

Connecticut has emerged as a significant battleground in the evolving landscape of earned wage access (EWA) legislation. As of October 1, 2025, the state implemented one of the country’s most restrictive EWA laws, reflecting a broader trend as six states introduced new regulations in 2025. The developments highlight the ongoing tension between industry players and consumer protection advocates.

Connecticut’s new law classifies earned wage access as a small-dollar loan, a departure from the classification used by most other states. Under this framework, EWA providers face stringent limitations, including a cap on advances at $750 and restrictions allowing only one advance per pay period unless users can access at least 75% of their wages. Additionally, finance charges are capped at $4 per advance or $30 monthly. Providers are also mandated to verify earned income using payroll data and to monitor for EWA advance stacking.

The relationship between Connecticut and the EWA industry has been contentious since at least 2023. That year, the state’s financial regulator categorized on-demand pay as a small-dollar loan, effectively banning many EWA services. Most providers exited the state, but ZayZoon chose to continue operations despite the regulatory hurdles. “We made it free,” said Darcy Tuer, CEO of ZayZoon. “People need [EWA], but the problem is that under that regulation we could not build our business under that model.”

The impact of these regulations is already evident. A study by the University of Connecticut School of Public Policy, commissioned by EWA provider DailyPay, indicated that consumers turned to high-interest payday loans after EWA services were curtailed. Tuer noted the unintended consequences of shutting down EWA access, stating, “If you shut [EWA] off, [consumers] flock to payday lenders.”

Industry Response and Legislative Action

Connecticut’s EWA law has become a focal point for both industry advocates and consumer protection groups. Industry stakeholders are advocating for more inclusive regulations that would allow broader access to EWA services. They plan to engage with state legislators in upcoming sessions to push for changes.

On the other hand, consumer advocacy groups have praised the stringent requirements of Connecticut’s law. “Connecticut is what we would have called the gold standard,” remarked Yasmin Farahi, deputy director of state policy at the Center for Responsible Lending. She emphasized the importance of the law’s consumer protections, which were achieved through significant advocacy efforts against industry narratives.

Some consumer groups argue that EWA should be classified under the same regulations as payday loans, advocating for a 36% interest rate cap similar to existing payday loan regulations. “If states are going to give these providers any leeway on what they charge, it’s absolutely essential to do what Connecticut did,” stated Laura Saunders, associate director at the National Consumer Law Center.

The Broader Landscape: Maryland Takes Action

As Connecticut shapes the narrative around EWA, Maryland is also emerging as a competitor in regulating this industry. In May 2025, Maryland became the tenth state to introduce regulations, following Connecticut’s lead in classifying EWA as a credit product.

Recent legal actions in Maryland highlight the ongoing scrutiny of EWA providers. The City of Baltimore filed a lawsuit against EWA provider MoneyLion, alleging misleading marketing practices and illegal interest charges. Mayor Brandon Scott stated, “MoneyLion has preyed on Baltimoreans, trapping our most vulnerable residents in borrowing cycles that made it harder for them to pay bills.” The lawsuit claims that MoneyLion’s fees and tips equate to an annual percentage rate (APR) significantly exceeding the state’s 33% maximum.

MoneyLion has faced additional legal challenges, including a lawsuit from New York Attorney General Letitia James for similar reasons. These developments suggest a growing concern among regulators regarding the practices of EWA providers and the potential impact on consumers.

Connecticut’s stringent EWA law and Maryland’s emerging regulations indicate a pivotal moment in the industry. As states grapple with the implications of earned wage access, the outcomes of these legislative efforts will shape the future landscape for both consumers and providers alike.

-

Science2 months ago

Science2 months agoOhio State Study Uncovers Brain Connectivity and Function Links

-

Politics2 months ago

Politics2 months agoHamas Chief Stresses Disarmament Tied to Occupation’s End

-

Science1 month ago

Science1 month agoUniversity of Hawaiʻi Joins $25.6M AI Project for Disaster Monitoring

-

Science4 weeks ago

Science4 weeks agoALMA Discovers Companion Orbiting Giant Star π 1 Gruis

-

Entertainment2 months ago

Entertainment2 months agoMegan Thee Stallion Exposes Alleged Online Attack by Bots

-

Science2 months ago

Science2 months agoResearchers Challenge 200-Year-Old Physics Principle with Atomic Engines

-

Entertainment2 months ago

Entertainment2 months agoPaloma Elsesser Shines at LA Event with Iconic Slicked-Back Bun

-

World1 month ago

World1 month agoFDA Unveils Plan to Cut Drug Prices and Boost Biosimilars

-

Business2 months ago

Business2 months agoMotley Fool Wealth Management Reduces Medtronic Holdings by 14.7%

-

Science2 months ago

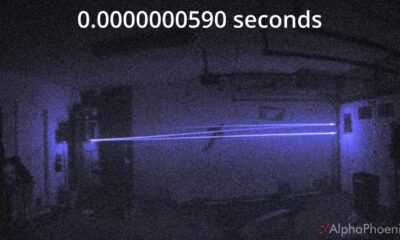

Science2 months agoInnovator Captures Light at 2 Billion Frames Per Second

-

Top Stories2 months ago

Top Stories2 months agoFederal Agents Detain Driver in Addison; Protests Erupt Immediately

-

Entertainment1 month ago

Entertainment1 month agoBeloved Artist and Community Leader Gloria Rosencrants Passes Away