Business

Shore Capital Maintains Buy Rating on Whitbread Shares Amid Market Analysis

Shore Capital has reaffirmed its buy rating for shares of Whitbread, listed on the London Stock Exchange as WTB, following a research note published on Thursday, October 19, 2023. This decision comes as part of an ongoing assessment of the company’s performance in the stock market, according to MarketBeat Ratings.

Several financial institutions have recently adjusted their target prices for Whitbread shares. On July 9, Berenberg Bank lowered its target price from GBX 3,900 to GBX 3,500, while maintaining a buy rating. In contrast, Citigroup raised its price target from GBX 3,600 to GBX 3,800 on August 21, 2023, also issuing a buy recommendation. Currently, four analysts have assigned a buy rating to the stock, with one analyst recommending a hold.

According to MarketBeat.com, Whitbread currently has a consensus rating of “Moderate Buy” and an average price target of GBX 3,425. This reflects a generally positive outlook from the market analysts.

Recent Financial Performance

Whitbread recently released its quarterly earnings results on October 16, 2023. The company reported earnings per share (EPS) of GBX 133.70 for the quarter, demonstrating a return on equity of 6.83% and a net margin of 8.08%. Analysts anticipate that Whitbread will achieve an EPS of approximately 227.19 for the current fiscal year.

About Whitbread

Whitbread is the owner of Premier Inn, which holds the title of the UK’s largest hotel brand. The company operates over 850 hotels with a total of 86,000 rooms across the UK and has expanded its footprint in Germany, where it operates 59 hotels with 10,500 rooms. Whitbread aims to provide quality accommodation at competitive prices in prime locations.

With a workforce exceeding 38,000 team members, the company is committed to delivering excellent service in its hotels across the UK and Germany.

For those interested in staying updated with the latest news and analysts’ ratings for Whitbread and related companies, a daily summary can be received through MarketBeat.com’s free email newsletter.

-

Science2 months ago

Science2 months agoOhio State Study Uncovers Brain Connectivity and Function Links

-

Politics2 months ago

Politics2 months agoHamas Chief Stresses Disarmament Tied to Occupation’s End

-

Science1 month ago

Science1 month agoUniversity of Hawaiʻi Joins $25.6M AI Project for Disaster Monitoring

-

Science4 weeks ago

Science4 weeks agoALMA Discovers Companion Orbiting Giant Star π 1 Gruis

-

Entertainment2 months ago

Entertainment2 months agoMegan Thee Stallion Exposes Alleged Online Attack by Bots

-

Science2 months ago

Science2 months agoResearchers Challenge 200-Year-Old Physics Principle with Atomic Engines

-

Entertainment2 months ago

Entertainment2 months agoPaloma Elsesser Shines at LA Event with Iconic Slicked-Back Bun

-

World1 month ago

World1 month agoFDA Unveils Plan to Cut Drug Prices and Boost Biosimilars

-

Business2 months ago

Business2 months agoMotley Fool Wealth Management Reduces Medtronic Holdings by 14.7%

-

Science2 months ago

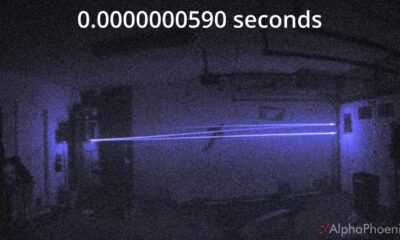

Science2 months agoInnovator Captures Light at 2 Billion Frames Per Second

-

Top Stories2 months ago

Top Stories2 months agoFederal Agents Detain Driver in Addison; Protests Erupt Immediately

-

Entertainment1 month ago

Entertainment1 month agoBeloved Artist and Community Leader Gloria Rosencrants Passes Away