Health

Michigan Insurer Blue Cross Faces Premium Hikes Amid Losses

Blue Cross Blue Shield of Michigan has reported a staggering loss of approximately $1.44 billion in 2024, prompting significant premium increases for employers and individual policyholders. The insurer, which serves about 4.5 million customers, has attributed part of the financial strain to rising hospital utilization and escalating costs of prescription drugs.

In response to these challenges, Blue Cross is set to raise its small group insurance premiums by an average of 12.4% for its Blue Care Network HMO plans next year. Individual market customers could face an average rate hike of 18.2%, which may increase further as federal tax credits for certain plans expire at the end of the year. Over the past three years, the insurer has accumulated total losses of around $1.35 billion, leading to a substantial adjustment in pricing strategies.

Rising Costs Drive Premium Adjustments

The increases in premiums reflect a broader trend of rising healthcare costs across Michigan. Executives at Blue Cross have indicated that the current model is unsustainable, with approximately $100 million being spent daily on medical and prescription drug expenses. According to Joe Radtka, vice president of enterprise finance and chief risk officer at Blue Cross, the organization has been struggling to keep pricing in line with its expenses.

“Quite frankly, we’ve been behind on pricing, and we’ve been trying to catch up ever since. And, to date, we have not done that,” Radtka stated. Other health insurers in Michigan are also seeking regulatory approval for significant rate hikes, with UnitedHealthcare requesting an average increase of 16.2% for small group plans and a substantial 25.3% for individual plans.

The Michigan Department of Insurance and Financial Services is expected to release its rate determinations by November 1, 2024, coinciding with the start of open enrollment.

Healthcare System Strains Insurers

The core issue leading to these premium hikes is a notable rise in healthcare utilization post-pandemic. Kirk Roy, chief actuary for Blue Cross, explained that the costs associated with inpatient and outpatient care now comprise a significant portion of the insurer’s expenditures. In fact, hospitals account for 47 cents of every dollar paid out in claims, while doctors and specialists receive 25 cents, and pharmaceuticals take up 21 cents.

This financial strain has drawn attention to the consolidation of hospital systems in Michigan. Major health systems such as Henry Ford Health and Corewell Health have expanded their reach, now serving around 60% of the state’s healthcare consumers. This consolidation has led to increased negotiating power over insurers, driving up costs without a corresponding improvement in health outcomes.

Blue Cross CEO Tricia Keith emphasized the need for a reevaluation of the healthcare financing model. “We’ve had negative underwriting margins for years, and that works for our model. But it can’t be quite as upside down as it is,” Keith noted. As costs continue to rise, the burden is increasingly falling on employers, particularly those in the small group market.

The trend of rising premiums has broader implications for small businesses. Employers are finding it increasingly difficult to manage healthcare costs, often leading to reduced benefits or increased out-of-pocket expenses for employees.

The financial turbulence in the healthcare sector has led to calls for regulatory reforms. Brian Calley, CEO of the Small Business Association of Michigan, stated that the $1.4 billion deficit incurred by Blue Cross indicates that the issue lies in the claims experience, rather than mismanagement by the insurer.

As the healthcare landscape evolves, stakeholders continue to seek solutions that will address rising costs while ensuring access to quality care. The ongoing discussions about hospital consolidation, the need for regulatory oversight, and innovative healthcare financing models remain critical as Michigan navigates these complex challenges.

-

Science2 months ago

Science2 months agoOhio State Study Uncovers Brain Connectivity and Function Links

-

Politics2 months ago

Politics2 months agoHamas Chief Stresses Disarmament Tied to Occupation’s End

-

Science1 month ago

Science1 month agoUniversity of Hawaiʻi Joins $25.6M AI Project for Disaster Monitoring

-

Entertainment2 months ago

Entertainment2 months agoMegan Thee Stallion Exposes Alleged Online Attack by Bots

-

Science4 weeks ago

Science4 weeks agoALMA Discovers Companion Orbiting Giant Star π 1 Gruis

-

Science2 months ago

Science2 months agoResearchers Challenge 200-Year-Old Physics Principle with Atomic Engines

-

Entertainment1 month ago

Entertainment1 month agoPaloma Elsesser Shines at LA Event with Iconic Slicked-Back Bun

-

World1 month ago

World1 month agoFDA Unveils Plan to Cut Drug Prices and Boost Biosimilars

-

Business1 month ago

Business1 month agoMotley Fool Wealth Management Reduces Medtronic Holdings by 14.7%

-

Top Stories2 months ago

Top Stories2 months agoFederal Agents Detain Driver in Addison; Protests Erupt Immediately

-

Entertainment1 month ago

Entertainment1 month agoBeloved Artist and Community Leader Gloria Rosencrants Passes Away

-

Science2 months ago

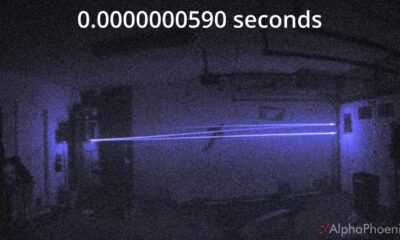

Science2 months agoInnovator Captures Light at 2 Billion Frames Per Second