Business

GBP/JPY Surges Back Above 208.00 as Market Awaits UK Data

The GBP/JPY cross has regained momentum, climbing back above the mid-208.00s during the Asian trading session on Friday. This resurgence follows a slight decline the previous day and is driven by renewed buying interest, particularly as traders anticipate significant economic data from the United Kingdom.

A combination of factors has contributed to the renewed strength of the GBP/JPY cross. Firstly, a softening of the Japanese Yen (JPY) has prompted some market participants to buy into the cross. This is largely due to concerns regarding Japan’s public finances and a prevailing risk-on sentiment that diminishes the allure of safe-haven assets like the Yen.

Market Dynamics and Upcoming Economic Indicators

The JPY’s position is further challenged by Prime Minister Sanae Takaichi‘s expansive public spending plans, which are raising investor concerns about fiscal sustainability. As equity markets show a generally positive tone, this has added downward pressure on the JPY, allowing GBP/JPY to regain some ground.

Despite these bullish signals for GBP/JPY, caution is warranted as the divergent monetary policy outlooks of the Bank of Japan (BoJ) and the Bank of England (BoE) may limit further gains. Expectations are growing for an interest rate hike from the BoJ, potentially as soon as next week, contrasting sharply with predictions that the BoE may lower borrowing costs at its upcoming meeting on December 12, 2025. This divergence could cap the upside for GBP/JPY as traders position themselves ahead of these pivotal central bank announcements.

Investors are eagerly awaiting the UK Office for National Statistics’ upcoming releases, including the monthly GDP report and Industrial Production figures, which are set to be published later today. These economic indicators are crucial as they will likely influence the value of the British Pound (GBP) and provide short-term trading opportunities in the GBP/JPY market.

The Industrial Production index, a key measure of output in UK production industries such as manufacturing and energy supply, will be closely monitored for signs of economic strength. Analysts anticipate a consensus figure of 0.7% growth, a notable recovery from the previous decline of -2%. A higher reading would be seen as bullish for the GBP, while a lower figure may trigger bearish sentiment.

Looking Ahead: Caution is Key

As traders prepare for the release of these significant economic indicators, there remains a need for caution. The upcoming week will also bring important data regarding UK employment, consumer inflation, and flash Purchasing Managers’ Index (PMI) numbers. These factors will likely shape market sentiment and could lead to volatility in the GBP/JPY cross.

In summary, while the GBP/JPY cross has shown resilience by climbing back above the mid-208.00s, traders are advised to exercise caution as significant central bank events and economic data loom on the horizon. The interplay between the BoJ’s potential rate hike and the BoE’s expected policy shift will be critical in determining the future direction of this currency pair.

-

Science2 months ago

Science2 months agoOhio State Study Uncovers Brain Connectivity and Function Links

-

Politics2 months ago

Politics2 months agoHamas Chief Stresses Disarmament Tied to Occupation’s End

-

Science1 month ago

Science1 month agoUniversity of Hawaiʻi Joins $25.6M AI Project for Disaster Monitoring

-

Science4 weeks ago

Science4 weeks agoALMA Discovers Companion Orbiting Giant Star π 1 Gruis

-

Entertainment2 months ago

Entertainment2 months agoMegan Thee Stallion Exposes Alleged Online Attack by Bots

-

Science2 months ago

Science2 months agoResearchers Challenge 200-Year-Old Physics Principle with Atomic Engines

-

Entertainment2 months ago

Entertainment2 months agoPaloma Elsesser Shines at LA Event with Iconic Slicked-Back Bun

-

World1 month ago

World1 month agoFDA Unveils Plan to Cut Drug Prices and Boost Biosimilars

-

Business2 months ago

Business2 months agoMotley Fool Wealth Management Reduces Medtronic Holdings by 14.7%

-

Top Stories2 months ago

Top Stories2 months agoFederal Agents Detain Driver in Addison; Protests Erupt Immediately

-

Science2 months ago

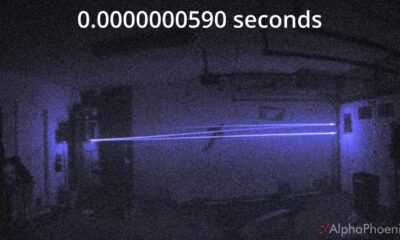

Science2 months agoInnovator Captures Light at 2 Billion Frames Per Second

-

Entertainment1 month ago

Entertainment1 month agoBeloved Artist and Community Leader Gloria Rosencrants Passes Away