Top Stories

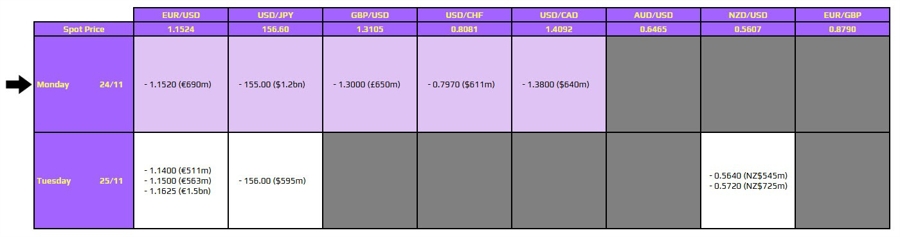

FX Options Expiry Update: Key Currency Movements Ahead of November 24

URGENT UPDATE: FX option expiries are set for November 24 at 10 AM New York time, and traders are on high alert as the market sentiment remains influenced by recent risk trends. With no significant expiries to report, focus shifts to ongoing movements in major currencies, particularly the Japanese yen and AUD/USD.

Trading sentiment is expected to pivot around the global risk mood. After last week’s selling pressure on the Japanese yen, market participants are keenly observing its performance. Additionally, the AUD/USD currency pair is teetering on the brink of its primary consolidation range between 0.6420 and 0.6600, a threshold that has held since June.

A breakdown below this critical range could signal heavier risk selling, prompting traders to watch for immediate developments in this pair. As the market evolves, the implications for traders and investors could be significant, influencing broader economic conditions and investment strategies.

For those seeking in-depth analysis, resources are available through InvestingLive (formerly known as ForexLive), providing key insights and market commentary. Stay tuned for further updates as the situation develops, and prepare for potential shifts in market dynamics affecting currency trading.

With trading conditions rapidly changing, the focus will remain on how global risk sentiment impacts these currencies in the lead up to the expiry. Be sure to monitor these developments closely to make informed trading decisions.

-

Science1 month ago

Science1 month agoOhio State Study Uncovers Brain Connectivity and Function Links

-

Politics1 month ago

Politics1 month agoHamas Chief Stresses Disarmament Tied to Occupation’s End

-

Entertainment1 month ago

Entertainment1 month agoMegan Thee Stallion Exposes Alleged Online Attack by Bots

-

Science4 weeks ago

Science4 weeks agoUniversity of Hawaiʻi Joins $25.6M AI Project for Disaster Monitoring

-

Science2 months ago

Science2 months agoResearchers Challenge 200-Year-Old Physics Principle with Atomic Engines

-

Entertainment1 month ago

Entertainment1 month agoPaloma Elsesser Shines at LA Event with Iconic Slicked-Back Bun

-

World1 month ago

World1 month agoFDA Unveils Plan to Cut Drug Prices and Boost Biosimilars

-

Top Stories1 month ago

Top Stories1 month agoFederal Agents Detain Driver in Addison; Protests Erupt Immediately

-

Business1 month ago

Business1 month agoMotley Fool Wealth Management Reduces Medtronic Holdings by 14.7%

-

Entertainment1 month ago

Entertainment1 month agoBeloved Artist and Community Leader Gloria Rosencrants Passes Away

-

Science3 weeks ago

Science3 weeks agoALMA Discovers Companion Orbiting Giant Star π 1 Gruis

-

Politics2 months ago

Politics2 months agoNHP Foundation Secures Land for 158 Affordable Apartments in Denver