Top Stories

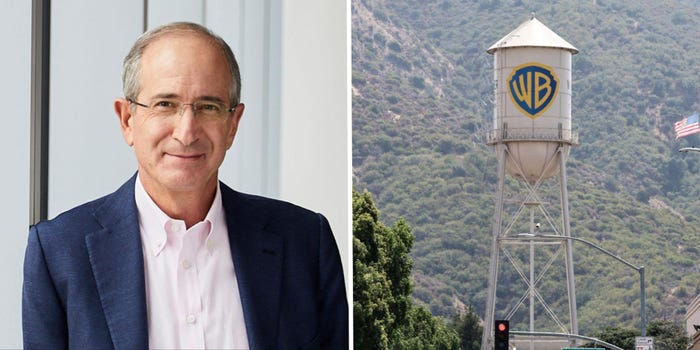

Comcast’s Urgent Bid for Warner Bros. Discovery Heats Up

UPDATE: A fierce bidding war for Warner Bros. Discovery (WBD) is intensifying, with Comcast emerging as a highly motivated contender. As of July 2023, Comcast’s co-CEO Brian Roberts is pushing hard to secure the media giant, positioning Comcast as a critical player against rivals like Paramount and Netflix.

This battle is urgent and pivotal for the future of streaming, as analysts suggest that WBD’s assets could significantly boost Comcast’s Peacock platform, which has been struggling with stagnant growth. With only 41 million subscribers in the U.S. and limited international reach, Peacock needs WBD’s HBO Max and Warner Bros. Studios to compete effectively in the global media landscape.

Rich Greenfield of LightShed Partners emphasized that acquiring WBD would be a “once-in-a-generation opportunity” for Roberts and Comcast, potentially transforming it into a media powerhouse that rivals Disney. He stated, “Comcast has always had Disney envy, and now it has a clear opportunity to create a Disney-like story.”

In contrast, while Paramount’s David Ellison is perceived to have an advantage due to strong industry ties, Comcast’s need for WBD’s streaming capabilities is becoming increasingly clear. Brandon Katz from Greenlight Analytics noted that “NBCU has the most to gain in raw streaming upside from a WBD acquisition.”

Analysts are also pointing out that the integration of HBO Max could provide substantial benefits for both Comcast and Paramount. Joe Bonner from Argus Research remarked, “HBO Max is the most obvious partner for the ‘inarguably sub-scale’ Peacock,” underscoring the potential revenue boost from a merger.

Despite the financial struggles with a low price-to-earnings ratio and significant debt, Comcast is actively pursuing this acquisition. The company has invested heavily in media rights, including major deals for NBA and MLB, indicating a strong commitment to enhancing its content portfolio.

However, regulatory hurdles loom, especially given past tensions between Roberts and former President Donald Trump. Media analyst Craig Moffett warned that the current administration could raise antitrust concerns that might complicate the deal. Yet, Greenfield believes that Comcast could navigate these challenges, possibly by addressing concerns raised by Trump, who has recently received donations from the media giant.

As this bidding war develops, the stakes are high for Comcast. If it fails to secure WBD, Peacock may remain “stranded without an obvious merger partner,” leading to further content deficits that could hinder its competitive position.

This unfolding situation is crucial for media industry watchers, as a successful acquisition could reshape the streaming landscape and redefine Comcast’s trajectory in the media sector. Keep an eye on this developing story for updates on the potential implications for the industry.

-

Science1 month ago

Science1 month agoOhio State Study Uncovers Brain Connectivity and Function Links

-

Politics1 month ago

Politics1 month agoHamas Chief Stresses Disarmament Tied to Occupation’s End

-

Entertainment1 month ago

Entertainment1 month agoMegan Thee Stallion Exposes Alleged Online Attack by Bots

-

Science4 weeks ago

Science4 weeks agoUniversity of Hawaiʻi Joins $25.6M AI Project for Disaster Monitoring

-

Science2 months ago

Science2 months agoResearchers Challenge 200-Year-Old Physics Principle with Atomic Engines

-

Entertainment1 month ago

Entertainment1 month agoPaloma Elsesser Shines at LA Event with Iconic Slicked-Back Bun

-

World1 month ago

World1 month agoFDA Unveils Plan to Cut Drug Prices and Boost Biosimilars

-

Top Stories1 month ago

Top Stories1 month agoFederal Agents Detain Driver in Addison; Protests Erupt Immediately

-

Business1 month ago

Business1 month agoMotley Fool Wealth Management Reduces Medtronic Holdings by 14.7%

-

Entertainment1 month ago

Entertainment1 month agoBeloved Artist and Community Leader Gloria Rosencrants Passes Away

-

Science2 weeks ago

Science2 weeks agoALMA Discovers Companion Orbiting Giant Star π 1 Gruis

-

Politics2 months ago

Politics2 months agoNHP Foundation Secures Land for 158 Affordable Apartments in Denver