Business

Huntsman Set to Release Q3 2025 Earnings Amid Market Pressure

Huntsman Corporation (NYSE:HUN) is scheduled to announce its third-quarter earnings for 2025 on Thursday, November 6, after the market closes. Analysts project the company will report a loss of $0.12 per share alongside a revenue of approximately $1.4511 billion for the quarter. Investors and stakeholders are encouraged to review the company’s earnings overview page for the latest updates, including details on the conference call set for Friday, November 7, at 10:00 AM ET.

Despite the anticipation surrounding the earnings report, Huntsman’s stock experienced a decline of 1.6% on Wednesday, opening at $7.89. The company’s shares have fluctuated significantly over the past year, with a 52-week low of $7.74 and a high of $21.64. Huntsman maintains a debt-to-equity ratio of 0.54, a quick ratio of 0.85, and a current ratio of 1.43. Its fifty-day moving average stands at $9.49, while the 200-day moving average is $10.63. Currently, the company boasts a market capitalization of $1.37 billion and a price-to-earnings (PE) ratio of -4.04.

Recent Institutional Activity

In recent months, several large investors have adjusted their holdings in Huntsman. Notably, EverSource Wealth Advisors LLC increased its stake by 181.9% during the second quarter, acquiring an additional 5,779 shares, bringing its total to 8,956 shares valued at approximately $93,000. Similarly, CW Advisors LLC and Caxton Associates LLP have established new positions valued at approximately $133,000 and $148,000, respectively. Prudential Financial Inc. also expanded its investment by 34.5%, owning 14,250 shares after purchasing an additional 3,655 shares. Collectively, institutional investors and hedge funds currently hold 84.81% of Huntsman’s stock.

Analysts on Wall Street are closely monitoring the company’s performance, anticipating potential growth in the coming quarters.

About Huntsman Corporation

Huntsman Corporation operates globally, manufacturing and selling a diverse range of organic chemical products. The company is divided into three primary segments: Polyurethanes, Performance Products, and Advanced Materials. The Polyurethanes segment, for instance, includes a variety of chemicals, such as methyl diphenyl diisocyanate and polyether polyols, among others.

As Huntsman prepares to deliver its financial results, investors remain interested in how these figures will reflect the company’s ongoing strategies and market dynamics. The upcoming earnings call may provide further insights into Huntsman’s future direction and operational performance.

-

Politics1 week ago

Politics1 week agoHamas Chief Stresses Disarmament Tied to Occupation’s End

-

Science3 weeks ago

Science3 weeks agoResearchers Challenge 200-Year-Old Physics Principle with Atomic Engines

-

Science1 week ago

Science1 week agoOhio State Study Uncovers Brain Connectivity and Function Links

-

Top Stories1 week ago

Top Stories1 week agoFederal Agents Detain Driver in Addison; Protests Erupt Immediately

-

Entertainment1 week ago

Entertainment1 week agoMegan Thee Stallion Exposes Alleged Online Attack by Bots

-

Entertainment2 weeks ago

Entertainment2 weeks agoSyracuse Stage Delivers Lively Adaptation of ‘The 39 Steps’

-

World3 weeks ago

World3 weeks agoGlobal Military Spending: Air Forces Ranked by Budget and Capability

-

Top Stories1 week ago

Top Stories1 week agoWill Smith Powers Dodgers to World Series Tie with Key Homer

-

Politics3 weeks ago

Politics3 weeks agoNHP Foundation Secures Land for 158 Affordable Apartments in Denver

-

Top Stories1 week ago

Top Stories1 week agoOrioles Hire Craig Albernaz as New Manager Amid Rebuild

-

Lifestyle1 week ago

Lifestyle1 week agoTrump’s Push to Censor National Parks Faces Growing Backlash

-

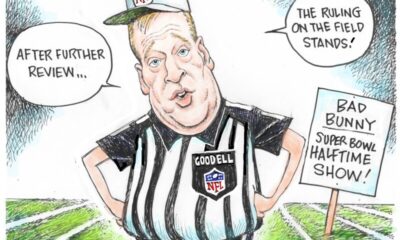

Politics1 week ago

Politics1 week agoNFL Confirms Star-Studded Halftime Show for Super Bowl LVIII