Business

Derry Sets New Tax Rate at $18.99 for 2025, Tax Bills Imminent

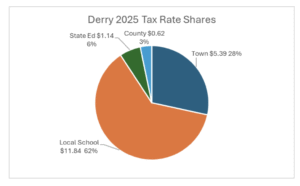

The Town of Derry has officially announced its tax rate for the year 2025, set at $18.99 per thousand of assessed value. This figure represents a 1.6% increase from the 2024 tax rate of $18.69, as determined by the New Hampshire Department of Revenue. Residents can expect their tax bills to reflect this new rate shortly.

The increase in the tax rate comes as local governments navigate the complexities of funding services and infrastructure. The rise of $0.30 per thousand of assessed value may impact residents’ budgets, prompting discussions about the allocation of public funds and the necessity of such adjustments.

Tax rates can significantly influence local economies, affecting not only homeowners but also businesses and renters within the community. This adjustment may lead to varying reactions among residents, with some welcoming the funding for essential services while others may express concern over rising costs.

In Derry, officials have emphasized the importance of maintaining quality services, which include public safety, education, and infrastructure maintenance. As the tax bills are prepared, local leaders are likely to communicate further details regarding how the funds will be utilized to benefit the community.

The new tax rate is set against the backdrop of ongoing discussions about fiscal responsibility and community needs. Residents are encouraged to review how the changes may affect their financial planning for the upcoming year.

As tax bills are generated, the town aims to provide clarity and transparency regarding the increase. Additional information will be shared through official channels to ensure residents understand the implications of the new rate.

-

Science1 month ago

Science1 month agoOhio State Study Uncovers Brain Connectivity and Function Links

-

Politics1 month ago

Politics1 month agoHamas Chief Stresses Disarmament Tied to Occupation’s End

-

Entertainment1 month ago

Entertainment1 month agoMegan Thee Stallion Exposes Alleged Online Attack by Bots

-

Science4 weeks ago

Science4 weeks agoUniversity of Hawaiʻi Joins $25.6M AI Project for Disaster Monitoring

-

Science2 months ago

Science2 months agoResearchers Challenge 200-Year-Old Physics Principle with Atomic Engines

-

Entertainment1 month ago

Entertainment1 month agoPaloma Elsesser Shines at LA Event with Iconic Slicked-Back Bun

-

World1 month ago

World1 month agoFDA Unveils Plan to Cut Drug Prices and Boost Biosimilars

-

Top Stories1 month ago

Top Stories1 month agoFederal Agents Detain Driver in Addison; Protests Erupt Immediately

-

Business1 month ago

Business1 month agoMotley Fool Wealth Management Reduces Medtronic Holdings by 14.7%

-

Entertainment1 month ago

Entertainment1 month agoBeloved Artist and Community Leader Gloria Rosencrants Passes Away

-

Science2 weeks ago

Science2 weeks agoALMA Discovers Companion Orbiting Giant Star π 1 Gruis

-

Politics2 months ago

Politics2 months agoNHP Foundation Secures Land for 158 Affordable Apartments in Denver