Business

Central Plains Bancshares Outperforms Chester Bancorp in Key Metrics

Recent analysis highlights a comparative evaluation between two small-cap finance companies: Central Plains Bancshares and Chester Bancorp. Both companies serve distinct markets, yet their performance metrics indicate a clear leader in investment potential. This assessment focuses on earnings strength, ownership composition, valuation, risk profiles, dividends, profitability, and analyst recommendations.

Institutional and Insider Ownership

Ownership structures reveal significant differences between the two firms. Central Plains Bancshares has 24.3% of its shares held by institutional investors, which often suggests confidence from larger investment entities. In contrast, Chester Bancorp shows a lower institutional ownership at 8.6%, while a notable 38.8% of its shares are owned by company insiders. This higher insider ownership may indicate a strong belief in the company’s future by its leaders.

Valuation and Earnings Performance

When examining financial performance, Central Plains Bancshares surpasses Chester Bancorp in both revenue and earnings per share (EPS). Specifically, Central Plains reports higher gross revenue figures, reflecting a more robust operational capacity. The implications of this data suggest that investors may find Central Plains a more appealing option based on current earnings strength.

Profitability metrics further support this conclusion. Central Plains exhibits superior net margins, return on equity, and return on assets compared to its counterpart, underscoring its efficiency and overall financial health.

Risk assessments also paint a clearer picture for investors. Central Plains Bancshares operates with a beta of 0.16, indicating its stock is 84% less volatile than the S&P 500. On the other hand, Chester Bancorp has a beta of 0.41, signifying it is 59% less volatile. Lower volatility can be attractive for risk-averse investors seeking stability in their portfolios.

Analyst Recommendations and Summary

According to MarketBeat, current analyst ratings further reinforce the position of Central Plains Bancshares as a more favorable investment choice. The firm outperforms Chester Bancorp in six of the eight factors analyzed, making it a compelling option for potential investors.

In summary, while both companies operate in the finance sector and provide a range of banking services, the financial metrics and ownership structures suggest that Central Plains Bancshares presents a stronger investment opportunity compared to Chester Bancorp. Investors may wish to consider these factors when making decisions regarding their financial portfolios.

For additional insights, stakeholders can receive updates on both companies by subscribing to MarketBeat.com’s daily email newsletter.

-

Science2 months ago

Science2 months agoOhio State Study Uncovers Brain Connectivity and Function Links

-

Politics2 months ago

Politics2 months agoHamas Chief Stresses Disarmament Tied to Occupation’s End

-

Science1 month ago

Science1 month agoUniversity of Hawaiʻi Joins $25.6M AI Project for Disaster Monitoring

-

Science1 month ago

Science1 month agoALMA Discovers Companion Orbiting Giant Star π 1 Gruis

-

Entertainment2 months ago

Entertainment2 months agoMegan Thee Stallion Exposes Alleged Online Attack by Bots

-

Science2 months ago

Science2 months agoResearchers Challenge 200-Year-Old Physics Principle with Atomic Engines

-

Entertainment2 months ago

Entertainment2 months agoPaloma Elsesser Shines at LA Event with Iconic Slicked-Back Bun

-

World2 months ago

World2 months agoFDA Unveils Plan to Cut Drug Prices and Boost Biosimilars

-

Science2 months ago

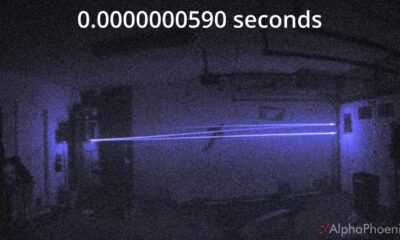

Science2 months agoInnovator Captures Light at 2 Billion Frames Per Second

-

Business2 months ago

Business2 months agoMotley Fool Wealth Management Reduces Medtronic Holdings by 14.7%

-

Top Stories2 months ago

Top Stories2 months agoFederal Agents Detain Driver in Addison; Protests Erupt Immediately

-

Entertainment2 months ago

Entertainment2 months agoBeloved Artist and Community Leader Gloria Rosencrants Passes Away