World

U.K. Economic Activity Declines 0.1%, Rate Cut Anticipated

The U.K. economy experienced a contraction of 0.1% in October 2023, marking a continuation of a downward trend in economic activity. This decline has heightened expectations that the Bank of England (BOE) will implement a reduction in its key interest rate during its upcoming meeting.

Economic indicators reveal that the decrease in activity reflects broader challenges facing various sectors. The Office for National Statistics reported that manufacturing and construction output suffered notable declines, contributing to the overall negative growth. Analysts suggest that persistent inflationary pressures and a tightening labor market are playing significant roles in this contraction.

Impact on Monetary Policy

As the BOE prepares for its next monetary policy decision, the implications of this contraction will likely dominate discussions. Economists predict that a rate cut could be implemented as soon as next week, with the aim of stimulating growth and providing relief to consumers and businesses alike. The current benchmark interest rate stands at 5.25%, and a reduction could mark a pivotal shift in the central bank’s approach to managing the economy.

The anticipated rate cut aligns with the BOE’s broader strategy to support economic recovery amid ongoing uncertainties. Following the contraction, Governor Andrew Bailey has indicated that the central bank is closely monitoring economic conditions and will act as necessary to maintain stability.

Broader Economic Context

The contraction in October is set against a backdrop of fluctuating economic performance in the U.K. Throughout 2023, the economy has grappled with various pressures, including rising energy costs and geopolitical tensions impacting trade. As the BOE weighs its options, external factors such as global economic conditions and domestic inflation rates will also come into play.

Additionally, consumer confidence remains fragile, affecting spending patterns and investment decisions. A rate cut may provide a necessary boost to consumer sentiment, encouraging spending and investment in key sectors.

In summary, the 0.1% contraction in October has significant implications for the U.K. economy and its monetary policy. With a potential interest rate cut on the horizon, the Bank of England faces critical decisions that could shape the economic landscape in the coming months.

-

Science2 months ago

Science2 months agoOhio State Study Uncovers Brain Connectivity and Function Links

-

Politics2 months ago

Politics2 months agoHamas Chief Stresses Disarmament Tied to Occupation’s End

-

Science1 month ago

Science1 month agoUniversity of Hawaiʻi Joins $25.6M AI Project for Disaster Monitoring

-

Science4 weeks ago

Science4 weeks agoALMA Discovers Companion Orbiting Giant Star π 1 Gruis

-

Entertainment2 months ago

Entertainment2 months agoMegan Thee Stallion Exposes Alleged Online Attack by Bots

-

Science2 months ago

Science2 months agoResearchers Challenge 200-Year-Old Physics Principle with Atomic Engines

-

Entertainment2 months ago

Entertainment2 months agoPaloma Elsesser Shines at LA Event with Iconic Slicked-Back Bun

-

World1 month ago

World1 month agoFDA Unveils Plan to Cut Drug Prices and Boost Biosimilars

-

Business1 month ago

Business1 month agoMotley Fool Wealth Management Reduces Medtronic Holdings by 14.7%

-

Top Stories2 months ago

Top Stories2 months agoFederal Agents Detain Driver in Addison; Protests Erupt Immediately

-

Entertainment1 month ago

Entertainment1 month agoBeloved Artist and Community Leader Gloria Rosencrants Passes Away

-

Science2 months ago

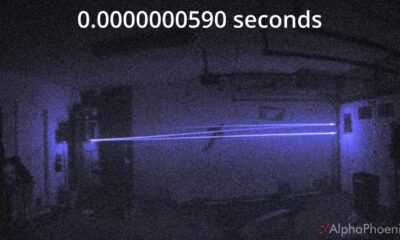

Science2 months agoInnovator Captures Light at 2 Billion Frames Per Second